The prognosis for the economy is becoming progressively worse. Last month, our economic managers were hopeful that 2020’s gross domestic product (GDP) would expand by 2.5% on the premise that we are able to catch up on the second semester. Two weeks ago, the National Economic and Development Authority (NEDA) adjusted its forecast, saying that the economy could no longer post positive growth and that we are now looking at a contraction of 2% to 3.4%.

Last week, New York based think tank Global Partners Inc. published a study saying that the Philippines was on its way to a contraction of 5% to 7%. This contraction is nearly as deep as what we experienced in 1985, our worst economic reversal since World War 2. It took us 25 years to recover from the economic devastation of 1984 and 1985.

A recession is now inevitable. The challenge is to recover as quickly as possible.

Acting NEDA Secretary Kendrick Chua recently submitted a plan to realize a V-shaped recovery. With a package of reforms, he hopes to induce the economy to rebound by 7.1% to 8.1% next year. The plan comes in two phases, the “Recovery Stage,” which will take effect from June to December, followed by the “Resiliency Stage,” which shall take place from 2021 onwards. Government has prepared a P1.49-trillion stimulus package to support the plan.

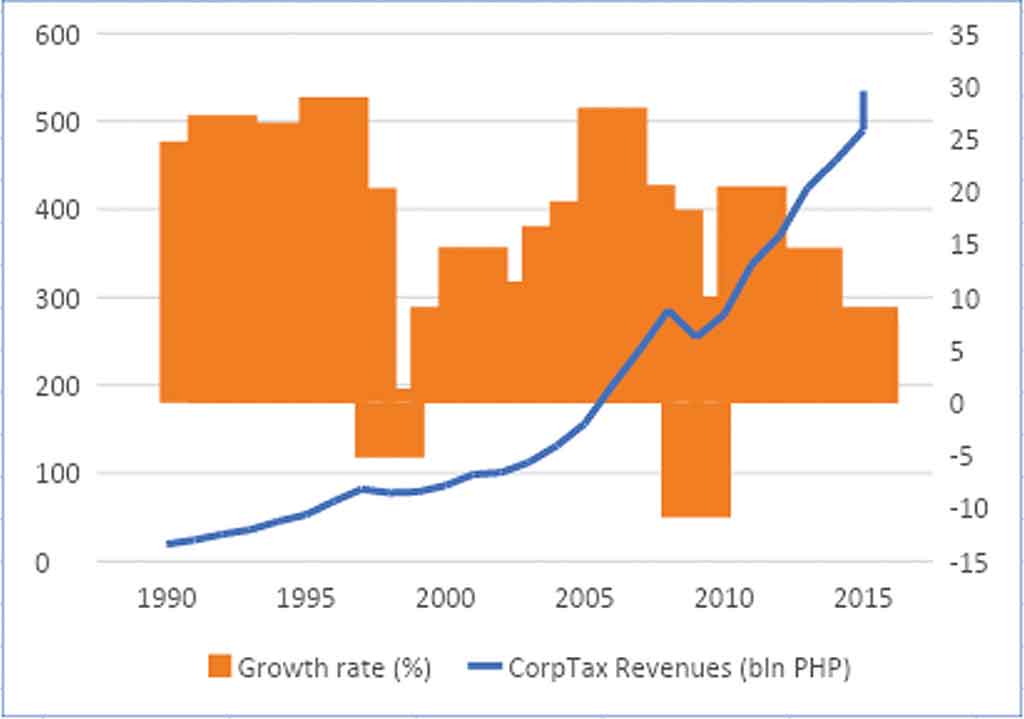

The Recovery Stage aims to minimize the impact of the pandemic on the economy. It calls for the enactment of three laws. The first is the Bayanihan Act 2 which is meant to prevent more job layoffs, save companies from insolvency, and stimulate consumer demand. The law calls for the appropriation of funds to strengthen healthcare, support agriculture and food manufacturing. It also provides loans and credit guarantees for local enterprises to save them from bankruptcies. The second is the enactment of a new law called CREATE (Corporate Recovery and Tax Incentives for Enterprises Act) which seeks to generate jobs, help local enterprises become profitable again and attract foreign investments. It proposes to reduce corporate income tax from 30% to 25%, a one-time 5% reduction; permit companies to carry-over losses for five years; offer tailor-made incentives to strategic foreign investors; maintain the same incentives for existing investors (to prevent them from leaving); and, provide tax incentives for government’s “Balik Probinsiya Program.” The third is the General Appropriations Act (GAA) of 2021. This law will be formulated in a way that it pump-primes the economy through massive spending on infrastructure, agriculture, healthcare and the food supply chain.

The Resiliency Stage, on the other hand, aims to strengthen the basic institutions of the country whilst setting the economy on a path of high growth. It involves a package of reforms that affect 11 aspects of economic and social development. On the economic side, it involves reforms to improve the country’s investment climate; business conditions; labor-related programs; agricultural productivity and logistics. On the social side, it involves reforms to bolster healthcare, education, digitization of government services, disaster response, social protection (SSS and Pag IBIG), and public transport

NEDA has brought forward a sensible plan which, no doubt, will put us in a better position to bounce back faster. However, we should not let this crisis go to waste. Now is the best time to enact controversial but necessary reforms we could not do in normal circumstances. I offer six reforms for the consideration of our economic managers:

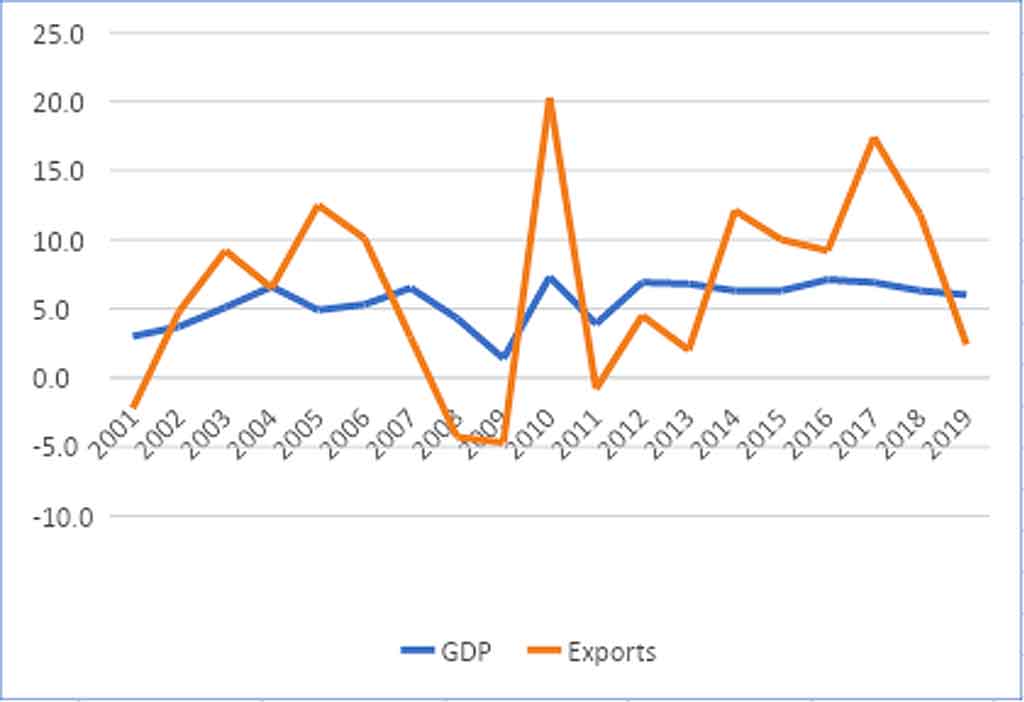

Economic policy towards industrialization. I wrote about this two weeks ago. Fact is, the economy has already been growing above its potential growth (or capacity to grow) from 2013 to 2016 such that growth has been on a path of steady deceleration since 2016. The only way to reverse the trend is to restructure the economy. This can be done through rapid industrialization. To keep the economy in its current structure will only result in lower growth and a further widening of our current account deficit.

Industrialization involves migrating the millions of low income workers in subsistence agriculture, hospitality and retail sectors to more sophisticated jobs in manufacturing and technical services; the second is a natural off-shoot of the first, which is to shift from being an economy driven by consumption and government spending to one that is lead by production. Third, to transform the economy from one that is a specialist in only two industries (electronics and BPOs) to one that specializes in a range of high value-added products including pharmaceutical manufacturing, industrial machineries, and the like. We must establish our industrial backbone in chemicals, iron and steel, artificial resins and plastic materials. The fourth is to climb the value chain where Philippine-made products become more technologically complex, unique, and renowned for quality.

Economic charter change. The restrictive provisions of the constitution have held back the country’s development for more than 30 years.

Embedded in the 1987 constitutions is a list of industries in which foreign investors are precluded from participation. These industries include agriculture, public utilities, education and media, among others. The absence of foreign investors in these sectors have starved us of capital, technology and competition to push local companies to be more efficient.

The protectionist flavor of the 1987 constitution clearly favored the interest of select Filipino families who are/were involved in media and broadcasting, power generation, and telecommunications. The constitution further limits foreigners from owning more than 40% equity share in corporations. This has led investors to either invest their money elsewhere or use several levels of dummy companies to evade the law. The latter breeds a domino effect of illegal acts.

We have lost billions worth of investments to our neighbors because of our constitution. It is high time to amend it. In the meantime, Congress should expedite the passage of the Foreign Investment Act, Public Service Act, and Retail Trade Act.

Grab our fair share of investments leaving China. FDIs bring capital formation, technology transfer, recurring income through taxes, exports revenues, and jobs. With half a million returning OFWs and nearly 3 million displaced workers, we need FDIs more than ever.

Fortunately, manufacturing companies from Japan, the US, and the European Union are leaving China. NEDA and the Board of Investment have adopted a strategy whereby they individually approach potential investors who serve a strategic purpose to us and offer them fiscal incentives tailor-made for them.

Nothing wrong with this strategy, but the problem is that the government has been so preoccupied with the COVID-19 crisis that it is not given this matter the attention it deserves. Our campaign to attract manufacturing firms leaving China must be quick and massive. We are in stiff competition with Vietnam, Indonesia, and Thailand and unless we act now, we will lose out on this investment bonanza like we did in 2008 and 2015.

Go back to Public Private Partnerships (PPP). With the urgent two-pronged need to pump-prime the economy and modernize infrastructure, the government must re-visit and aggressively pursue PPP financing, including unsolicited proposals. It should no longer delay (and finally green light) projects that have been under protracted negotiations for years. I am referring to the Bulacan Airport and NAIA Rehabilitation. The scale of these projects will be a boon to job generation.

Investments in Food Security. The disruption of the logistics chain after the enactment of the Enhanced Community Quarantine (ECQ) would have resulted in a food shortage had the government not played its diplomatic card to persuade Vietnam to continue exporting rice to us. Sadly, local production of rice, vegetables, and meats is insufficient to feed our ever-growing population. We are dependent on imports for the lion’s share of our food requirements.

What we need is a green revolution to achieve self sufficiency in food production. It is imperative that we make the shift from traditional farming to technology-assisted farming. Unfortunately, agricultural development is stymied by the Comprehensive Agrarian Reform Law (CARL). The five hectare limitation on land ownership relegates farmers to subsistence farming and low productivity. Economies of scale cannot be achieved with such a small amount of land. The need to amend CARL cannot be overstated. We also need to amend the Agri-Agra Credit Law and Warehouse Receipts Law to make agricultural industries flourish.

Prepare for a Digital Economy. The post-COVID-19 world will be one where we live and work in the digital sphere. Work from home will become the new norm, gig employment (freelancers and outsourced services) will become increasingly common, and goods and services will be bought and sold through the internet. Bills will be paid online, interactions with government agencies will be done through the net, the same with banking.

All these necessitate fast and reliable internet service. Although broadband service has improved in the last year, it is still slow against world standards. Reforms must be put in place to induce healthy competition in the industry. Government must lower the barrier to entry of new players to encourage more investments in digital infrastructure. It must also call Dito Telecoms (formerly Mislatel) to task to expedite its much-delayed 5G roll-out. In addition, internet service providers (ISPs) and value-added service providers must be able to connect directly to satellites for broadband connectivity and be allowed to share in cellular tower infrastructure.

The Open Access in Data Transmission Act must be passed and the Public Service Policy Act must be amended.

We have a window of opportunity to fix the laws that impede national development. Let’s hope the government uses this opportunity to fix all that is wrong with our system and create a stronger republic.

Andrew J. Masigan is an economist.