Stakeholder Maximization vs the Friedman Rule: What should business schools teach?

Milton Friedman’s view (1971) that the social responsibility of business is to maximize shareholder value has guided business behavior over the last 50 years. With the dividends or capital gains, shareholders can dump the stocks of firms that violate their ethical standards; and can consume goods productive of externality of their choice.

Governments, on the other hand, set the rules of the game according to the preference of society and address market failures (externalities). This separation rule makes pressing accountability easier. Shareholder value maximization (SHVM) within the parameters of the rules will benefit society.

Arrayed against SHVM is the increasingly popular ethic of stakeholder value maximization (STVM). What to inculcate in our business schools? A virtual conference organized by Philippine Institute for Development Studies (PIDS) partly tackled this issue. The star of the show was Prof. Luigi Zingales of the University of Chicago, one of the advocates of re-thinking of the Friedman orthodoxy.

“Stakeholder” means many things to many people: it includes everyone the firm touches: workers, consumers, and the whole world when it comes to externalities. The set of pied pipers seems ill-defined to start, prompting moderator Romy Bernardo’s quip about serving “too many masters.” Romy’s ruminations and moderator Dr. Maggie Debuque’s review piece “Rethinking Capitalism” helped this piece mightily. I was just an interested kibitzer. One issue uncovered by the webinar, viz., sustainability, is our focus here. Let’s start with an example.

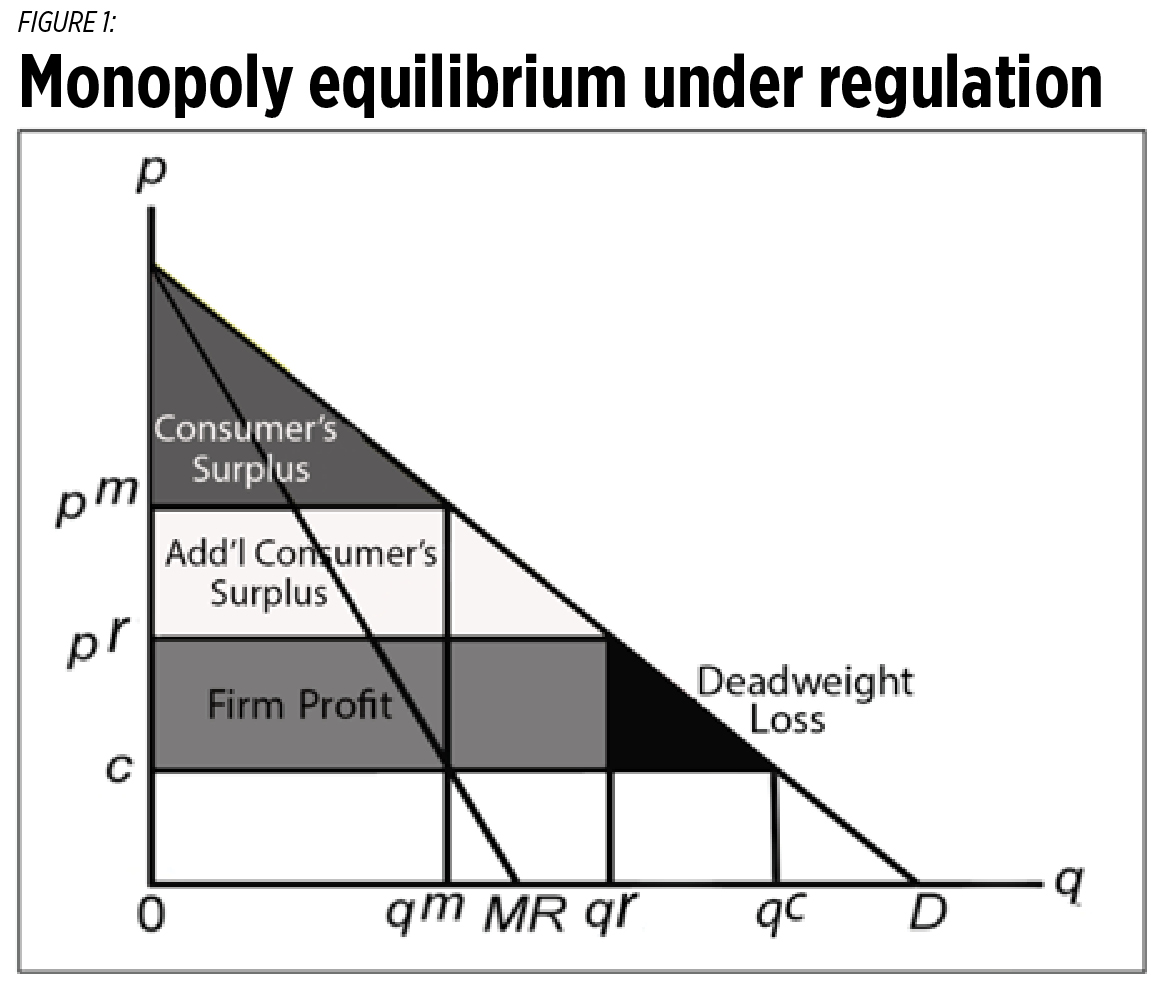

Meralco is the franchised monopoly power distributor serving Metro Manila and environs. It operates at a price-quantity combination (pr, qr) approved by the Energy Regulatory Commission or ERC (different than the unregulated combination [pm, qm] in the graph; see Figure 1).

ERC’s intervention enlarges consumer welfare by “Additional Consumer’s Surplus” (no shade) and reduces social waste (smaller Deadweight Loss [DWL hereon], black) than when unregulated.

Consider the following: a power consumer advocacy group, Kuryente.com proposes to Meralco the following deal: You produce at perfectly competitive combination (c, qc) (see Figure 1) and we promise to pay you your previous profit (shaded rectangle) plus (1/2) DWL; Meralco is strictly better off but so are consumers who collect the following: (CS + Add’l CS + (1/2) DWL). Should Meralco accept?

If Meralco is a stakeholder maximizer, “Yes.” That is because the contract will result in zero social waste (DWL = 0) which maximizes stakeholder value. But will Meralco survive the deal as a market player? No!

Kuryente promises to pay Meralco “firm profit + (1/2) DWL” by collecting prorated contributions from consumers. Can Kuryente deliver? No! If some or all power consumers resist paying back, the transactions cost of collecting will be so high, it will eat up all the potential gains of the bargain (the DWL). Kuryente’s promise becomes “cheap talk.” And acceptance will put Meralco on the path to bankruptcy or a government takeover.

Kuryente, however, can deliver if every power consumer is also a stakeholder maximizer eagerly paying for what is good for the whole community. Belief in such elevated humanity is noble but naive. Recall the overambitious but long discarded adage, “From each according to his capacity, to each according to his need.”

On the consumer side, suppose two firms otherwise identical produce same commodity X, say, beef. Cow-based CO2 emission is about 15% of global CO2 emission. Stakeholder maximizer Firm 1 pays extra for pricier new calcium nitrate-boosted feeds that produce less methane in cow farts and burps while Firm 2 does not. Thus, Firm 1’s cost is higher per unit than Firm 2’s. Will consumers buy the pricier Firm 1 beef over the lower price Firm 2 beef? Yes, if beef consumers are themselves stakeholder maximizers (see also, Philippine Daily Inquirer, Oct. 28, on this). But betting real money on such “ifs” is foolhardy.

On the financial side, will the equity investors push the price of Firm 1 stocks higher to match Firm 2’s even if Firm 2 pays higher dividends? Yes, if investors are also stakeholder maximizers. Once more, hard-nosed businessmen don’t bet on such “ifs.”

The message here is clear: stakeholder maximization is sustainable only if the ethic is universally shared. Only when roguery has vanished from the land can the police be dispensed with. If only reality was kinder to utopias.

Hart and Zingales (2017) wisely batted for a halfway target of “shareholder welfare” (what makes shareholders happy rather than what makes shareholders rich). If Firm 1 shareholders are slightly altruistic, and allowed to vote effectively, Brocardo, Hart and Zingales (2020) show that they will force Firm 1 to maximize shareholder welfare. But If Firm 2’s shareholders are not kindred spirit, Firm 1 will still lose out to Firm 2 in the market. Whether “shareholder welfare” or “stakeholder value,” market sustainability requires universal sharing of the ethic.

In the post-WWII era, the compromise was government ownership of commanding heights of the economy such as Meralco. The state collects taxes to subsidize the operations of such entities. Not being profit-oriented, state-owned corporations will “theoretically” operate at (c, qc). But this theory crumbled when the rubber hit the road: Schumpeter’s “creative destruction” folded its tent resulting in stunted innovation and aborted rebirthing; “soft budget constraint” for state firms fueled bad and/or self-serving decisions on manning and investment. These battered the sails of the commanding heights economy of Great Britain and the Socialist sphere. The Thatcher revolution put finis to the endeavor.

The Friedman rule is vulnerable where the state-market separation is breached — massive corporate resources can bend political rules in their favor. Which is why Zingales (2021) batted for the Friedman rule to hold only for small, but not for large, corporations. In weak rule-of-law jurisdictions, the firewall between rule-making and profit-seeking is porous. And the Philippines is a weak rule-of-law jurisdiction. According to the WJP 2021 Rule of Law index, the Philippines now ranks at No. 102, showing a steady decline from No. 51 in 2015. Thus, questions of the sort beg ventilation: Is a certain high-flying businessman’s unusually rapid rise to economic power due to remarkable business acumen maximizing shareholder value or due to some cozy exclusive connection with the sitting powers? Was the Pharmally P8-billion contract truly above board or did it take some extra-curricular avenues?

The central question here, however, is different: Would STVM make a difference in a weak rule-of-law jurisdiction? Once more, if the ethic is not universally shared and especially not by the sitting political power, it won’t make a difference in market economies. If one prospective high-flying businessman shuns undue favors, another one will come forward or will be created, who won’t.

The requirements for sustainable STVM in market economies are so onerous the ethic is utopian. The coalition of the virtuous will collapse if remnants of villainy remain. But villainy, like death and taxes, will always be with us. Life is colorless otherwise. This means that the Friedman rule remains properly hinged. There will always be a place for the likes of Bill and Melinda Gates Foundation in the market economy.

Business schools take note.

References: (not included in published material)

Debuque, Margarita, 2021. “Rethinking capitalism,” PIDS monograph.

Hart and Zingales, 2017. “Companies should maximize shareholder welfare not shareholder value,” Journal of Law Finance and Accounting 2 (2), 247-75.

Brocardo, Hart and Zingales, 2020. “Exit vs. voice” WP #2020-114, Becker Friedman Institute for Economics, University of Chicago.

Friedman, M., Sept. 13, 1970. “The social responsibility of business is to increase its profits,” The New York Times.

Zingales Luigi, October 2021. “Resetting capitalism,” Powerpoint presentation for PIDS Webinar, September 2021.

Philippine Daily Inquirer, Oct. 28, 2021. “Gas giants: Can we stop cows from emitting so much methane?”

Raul V. Fabella is a retired professor of the UP School of Economics, a member of the National Academy of Science and Technology and an honorary professor of the Asian Institute of Management. He gets his dopamine fix from bicycling and tending flowers with wife Teena.