IN BRIEF:

• The BIR’s Digitalization Program aims to modernize and enhance the efficiency, transparency, and effectiveness of tax administration and revenue collection processes.

• The BIR envisions taxpayers as customers, adopting taxpayer-centric views in their services. Completed projects reflecting this approach include the Online Registration Update System (ORUS), Enhancement of the Electronic One-Time Transaction (eONETT) System, and the Optimized Knowledge Management System for Chatbot Revie.

• Despite foreseeable challenges such as increased security risks and budget constraints, the BIR is prepared to address them by focusing on system upgrades, modernization, and adhering to its vision of collecting taxes through the just enforcement of tax laws.

Change is inevitable in today’s dynamic environment. To keep pace with rapid modernization, organizations must evolve their offerings to meet public needs. On Jan. 8, a key official of the Bureau of Internal Revenue (BIR) shared insights at the 3rd Tax Symposium of SGV, discussing how the BIR is adapting to modernization and transforming its services to meet the evolving needs of taxpayers.

EVOLUTION OF THE BIR DX ROADMAP

The BIR revitalized its digital transformation journey with the issuance of Revenue Memorandum Order (RMO) No. 27-2020, known as the BIR Digital Transformation (DX) Roadmap 2020-2030. This initiative was pursued in compliance with Republic Act No. 11032 or the Ease of Doing Business and Efficient Government Service Delivery Act of 2018, which requires government offices to assess and improve their transaction systems and procedures. The DX Roadmap is built around three core principles: adopting a people-first approach, instituting a process perspective, and embracing digital technology, with a digital transformation mindset as its foundation.

Recognizing the need for a more comprehensive and updated roadmap, the BIR issued RMO No. 48-2024, known as the Adoption of the New BIR Digital Transformation Roadmap for CY 2025-2028. This initiative aligns with Section 43 of RA No. 11976, or the Ease of Paying Taxes Act, which requires the BIR to adopt an integrated digitalization strategy by providing automated end-to-end solutions for taxpayers. The roadmap also reflects BIR Aspiration 2028, which envisions the BIR as highly digital and propelled by empowered revenue officers with integrity, providing excellent services aligned with international tax standards.

PROJECT UPDATES

The speaker emphasized that despite recent legislation requiring the digital transformation of BIR services, the BIR has long been committed to making its services convenient and efficient for the public. This commitment is evident in the expansion of eServices and the leveraging of technology for a robust tax administration.

It was highlighted that during the time when the world stood still due to the COVID-19 pandemic, the BIR’s Electronic Filing and Payment System (eFPS), e-BIR Forms, and electronic payment facilities were already in place. This allowed taxpayers to efficiently comply with their filing and payment duties.

A report on the status of projects under the BIR DX Program for CY2024 as of Nov. 30, 2024 was also presented. There are eight completed projects and eight ongoing projects.

Completed projects include the Online Registration Update System (ORUS), Enhancement of the Electronic One-Time Transaction (eONETT) System, Optimized Knowledge Management System for Chatbot Revie, Property Management System (PMS) (National Office Phase), Expansion of Digital Platform and Tools, Establishment of a Command Center with IT Operations Center, Enterprise Risk Management (ERM), and Enhanced Monitoring and Managing Administrative Cases (EMMAC).

Meanwhile, ongoing projects include the Project 230X, Electronic Tax Clearance System (eTCS), Electronic Invoicing/Receipting and Sales Reporting System (EIS/SRS), eAppointment (BIR Services under Assessment and Collection Service, Development of Cloud Based Electronic Documentary Stamp Tax (eDST) System, Document Tracking Management System (DTMS), Cybersecurity Program and Internal Revenue Integrated System (IRIS).

Eleven other projects under the DX Program are in varying stages of project planning and execution. These include taxpayer-facing projects as well as projects for internal customers.

A notable highlight of the DX project is the EIS/SRS Program. Republic Act No. 10963 or the Tax Reform for Acceleration and Inclusion Law (TRAIN Law) authorized the establishment of a system capable of storing and processing the required data within five years from the effectivity of the Law. Republic Act No. 12066 or the CREATE MORE Law removed the five-year implementing period. In terms of updates, out of the 100 Pilot Taxpayers, 63 are currently transmitting their sales data.

The ongoing Tax Modernization Feasibility Study Project will determine the best way forward for the EIS/SRS program. The study’s result will be out towards the end of the first quarter of 2025. By then, the Bureau can provide firmer guidelines and timelines regarding the EIS/SRS implementation.

Further, under the CREATE MORE Law, taxpayers under the jurisdiction of the Large Taxpayer Service and exporters are still covered both by the requirement of issuing electronic invoices (EIS) and electronic reporting of their sales (SRS) data to the Bureau. What was amended is that those engaged in e-commerce are only required to comply with the EIS, but it is not mandatory for them to comply with the SRS program. Instead, they may opt to voluntarily comply.

Meanwhile, other taxpayers may voluntarily issue electronic invoices and use an SRS. Those who volunteer will be granted incentives, specifically an additional deduction from taxable income of 100% total cost for setting up an EIS/SRS for taxpayers classified as micro and small and an additional 50% for medium and large, which can only be availed of once.

MODERNIZING TAX SERVICES

Transformation is not just about modernization. It aims to establish a more efficient, transparent, and responsive tax administration capable of addressing the changing needs of the public.

As the BIR strives for transformative and modernized services for taxpayers, it acknowledges foreseeable challenges such as increased security risks, budget constraints, customer/taxpayer readiness, among others. Nonetheless, the BIR is prepared to address these challenges.

These developments in the BIR’s DX Program give taxpayers a renewed optimism recognizing the significance of its successful implementation in improving tax processes towards realizing BIR’s vision of a modern, efficient, and technology-driven tax system that benefits both the taxpayers and government.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views and opinions expressed above are those of the authors and do not necessarily represent the views of SGV & Co.

Thyrza F. Marbas is a tax partner and Rule Amethyst L. Oporto is a tax senior manager of SGV & Co.

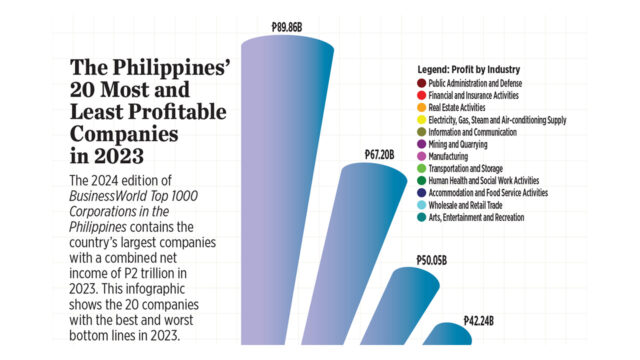

The BusinessWorld Top 1000 Corporations in the Philippines can be purchased directly by reaching out to BusinessWorld’s Circulation Department at (+63 2) 8527-7777 locals 2651 to 2654 or via e-mail at circ@bworldonline.com. The portable document format (PDF) version will also be available for purchase at https://bworld-x.com/.

The BusinessWorld Top 1000 Corporations in the Philippines can be purchased directly by reaching out to BusinessWorld’s Circulation Department at (+63 2) 8527-7777 locals 2651 to 2654 or via e-mail at circ@bworldonline.com. The portable document format (PDF) version will also be available for purchase at https://bworld-x.com/.