PSEi rises to 7,000 level on lower COVID-19 cases

PHILIPPINE shares climbed past the 7,000 mark on Wednesday on the country’s improving coronavirus disease 2019 (COVID-19) situation and the slower inflation print logged in September.

The Philippine Stock Exchange index (PSEi) gained 76.21 points or 1.09% to close at 7,057.45 on Wednesday, while the all shares index rose 50.97 points or 1.17% to end at 4,409.14.

“PSEi’s breakout above 7,000 reflects growing optimism about greater economic reopening (potentially a shift to Alert Level 3 in the weeks ahead) as infection cases slow and the generally risk-on mood in offshore equities markets,” First Metro Investment Corp. Head of Research Cristina S. Ulang, head of research at First Metro Investment Corp., said in a Viber message.

“Investors took positively the recently released inflation report for the month of September, as well as the improving COVID-19 situation in the country,” Timson Securities, Inc. Trader Darren Blaine T. Pangan said in a separate Viber message.

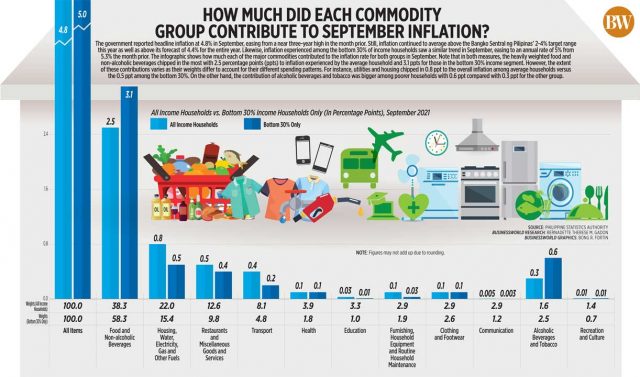

Headline inflation slowed to 4.8% in September from the 4.9% recorded in August, the Philippine Statistics Authority reported on Tuesday.

Meanwhile, the country logged 9,055 new COVID-19 infections on Tuesday. Active cases stood at 103,077, while the national tally went up to over 2.61 million.

The country has received 77.4 million vaccine jabs so far. As of Oct. 5, the government has administered nearly 47.78 million vaccine doses with over 22.4 million fully vaccinated.

The government hopes to vaccinate 50% of the population by the end of the year.

The Finance department on Tuesday said it is in talks with the World Bank, the Asian Development Bank and the Asian Infrastructure Investment Bank to secure up to P45.6 billion or $900 million in loans to procure vaccines.

All sectoral indices closed in the green on Wednesday. Property climbed 70.76 points or 2.35% to 3,073.38; services went up 45.82 points or 2.32% to 2,017.13; mining and oil rose 136.33 points or 1.41% to finish at 9,763.74; financials gained 17.57 points or 1.24% to 1,430.81; industrials improved by 112.09 points or 1.08% to 10,441.98; and holding firms inched up by 10.40 points or 0.14% to 7,027.73.

Value turnover went up to P9.55 billion with 2.71 billion issues traded on Wednesday, an improvement from the P6.57 billion with 1.08 billion shares that switched hands on Tuesday.

Advancers beat decliners, 113 against 92, while 41 names closed unchanged.

Net foreign selling slowed to P356.05 million on Wednesday from the P709.34 million logged the previous day.

“The next immediate resistance lies at the 7,320 area as we see in the coming days if the 7,000 level holds,” Timson Securities’ Mr. Pangan said. — Keren Concepcion G. Valmonte

Peso weakens vs the dollar on higher oil prices

THE PESO weakened versus the greenback on Thursday as oil prices soared to multi-year highs.

The local unit closed at P50.88 per dollar on Wednesday, shedding 23 centavos from its P50.65 finish on Tuesday, based on data from the Bankers Association of the Philippines.

The peso opened Wednesday’s session a tad stronger at P50.64 a dollar. Its weakest showing was at P50.90, while its intraday best was at P50.61 against the greenback.

Dollars exchanged dropped to $963 million on Wednesday from $1.019 billion on Tuesday.

The peso depreciated on demand for the safe-haven dollar as oil prices soared after major producers and their allies maintained their targeted output pace despite calls to beef up production amid growing demand for fuel, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said.

Oil prices surged on Wednesday after the Organization of the Petroleum Exporting Countries and their allies refused to boost production amid concerns over tight energy supply globally, Reuters reported.

Brent crude rose to $83.47 on Wednesday, the highest since October 2018, before settling at $82.52 per barrel by 0813 GMT. Meanwhile, US crude climbed to $79.78, the highest since November 2014, before going down 10 cents to $78.83.

Meanwhile, a trader said peso-dollar trading was also affected by expectations of a strong US new private jobs report overnight.

The ADP National Employment Report for August was set to be released on Wednesday. Private payrolls rose by 374,000 jobs in July.

For Thursday, Mr. Ricafort gave a forecast range of P50.75 to P50.95 per dollar, while the trader expects the local unit to move within P50.80 to P51 versus the greenback. — LWTN with Reuters

Angat power plant rehab terms finalized — MWSS

THE Metropolitan Waterworks and Sewerage System (MWSS) said it finalized the terms for the rehabilitation of two turbine units of Angat Hydroelectric Power Plant in Norzagaray, Bulacan.

The MWSS Corporate Office said the Rehabilitation, Operation and Maintenance Agreement with Angat Hydropower Corp. (AHC) was signed on Sept. 28, involving the modernization of the plant’s auxiliary turbine units no. 4 and 5.

“It is an important water security legacy project harmonizing and maximizing the use of the structures shared by the operators of water supply and power supply in Metro Manila, in Angat Dam,” the MWSS said in a statement Wednesday.

The MWSS said the two turbine units are old and have been inoperable since 2013.

Auxiliary turbine unit no. 4 entered service in June 1986 with a capacity of 10 megawatts (MW), while turbine unit no. 5 began operating in January 1993 with a capacity of 18 MW.

According to the MWSS, the Angat Hydroelectric Power Plant is owned by AHC except for the two auxiliary turbine units.

“Under the agreement, MWSS will retain ownership of its assets, including its water rights. AHC will operate the facilities on a commercial basis and will be responsible for all capital maintenance. A single operator for the Angat Hydroelectric Power Plant will not complicate operations, but will actually ensure continuous water supply,” then-MWSS Chairman Reynaldo V. Velasco said during the signing.

Mr. Velasco vacated his position as MWSS Chairman and Acting Administrator on Sept. 30 as he will running for a seat in the House of Representatives in 2022 under the Philippine National Police Retirees Association, Inc. party-list.

Mr. Velasco was replaced by Leonor C. Cleofas.

Once completed, the MWSS said the turbines will provide additional power to the Luzon grid, which will help lower power costs.

“There will be a more sustainable energy generation mix and lower dependency on carbon fuels such as coal and gas, which the country imports, and additional taxes generated for the government from the operation of the Angat Hydroelectric Power Plant,” the MWSS said. — Revin Mikhael D. Ochave

Digitalization highlights urgency of creative industries law, DTI says

THE NEED for a creative industries law has been made more urgent by digitalization, with the industry needing to exploit the opportunities available to it in order to drive the industry’s recovery, a Trade department official said.

“The crisis has accelerated digitalization and we would like to take advantage of the opportunities offered by the availability of new technologies and use these tools to drive the recovery of the creative industry… To jumpstart the process, the approval of the Creative Industries (Development) Act is needed,” Trade and Industry Undersecretary Rafaelita M. Aldaba said.

She was speaking at a forum Wednesday organized by the American Chamber of Commerce of the Philippines (AmCham).

Ms. Aldaba said that the pandemic has significantly affected the creative industry, with creative exports falling last year to $6.2 billion from $6.7 billion in 2019.

She said that 61% of companies in the arts and entertainment sector halted operations, with 21% shutting down permanently.

However, she noted opportunities such as the transition to digital platforms like Netflix, Inc., whose Filipino users grew by 1 million in 2020. She valued the resulting revenue at $79 million.

Museums and events such as the National Museum and Art Fair Philippines have also opened online platforms for digital exhibits and tours.

Ms. Aldaba said earlier that the Philippines must address constraints to industry expansion, including high costs in the film and gaming sectors, low levels of investment, and a Philippine bias for foreign creative goods.

The proposed Philippine Creative Industries Development Act seeks to establish the Philippine Creative Industry Development Council under the Department of Trade and Industry (DTI) that will be responsible for promoting the development of creative content and protecting creators from intellectual property infringement.

The council will have 17 members, nine from the private sector and eight from various government agencies. It will draft a Philippine Creatives Industries Development Plan.

The bill, if passed, will also establish a Creative Industry Development Fund for research and development, with a trade promotion component. It will set up one-stop registration centers for micro, small, and medium creative enterprises to avail of government services.

Creative industries covered by the bill are audio and audiovisual media; digital interactive media; creative services; design; publishing and printed media; performing arts; visual arts; traditional cultural expressions; and cultural sites.

The bill was approved in the House of Representatives on Sept. 20. It was supported by various foreign chambers, including AmCham.

Pangasinan Rep. Christopher P. de Venecia, chairman of the House Committee on the Creative Industry and Performing Arts, said if signed into law, the measure will help the creative industry catch up with its regional peers.

“While Filipinos continue to love Hollywood and Western content, and recently Korean content and culture as well, it won’t be long before our country’s own consumers start getting into (Southeast Asian) content because our neighbors are many steps ahead in creative industries policymaking and programming,” he said.

Senator Aquilino L. Pimentel III, chairman of the Senate Committee on Trade, Commerce and Entrepreneurship, said during the forum that the panel has approved the chamber’s counterpart bill and has finalized its committee report.

He hopes to lobby for the passage of the bill once plenary debates resume in November. — Russell Louis C. Ku

Securities regulator targets eradication of financial scams

THE Securities and Exchange Commission (SEC) said it has set a target of a “scam-free financial environment” following a surge in unlicensed investment solicitations during the pandemic.

“We recognize the importance and continue to strive for a scam-free financial environment, which will only be possible if we work together with the public in exposing and avoiding fraudulent schemes,” SEC Chairman Emilio B. Aquino said in a statement Wednesday.

The regulator has issued 87 advisories against entities offering unlicensed investment programs to the public this year. The SEC issued 126 advisories in 2020, more than double the 50 advisories in 2019.

Four cease-and-desist orders were also issued by the commission against 15 groups and individuals over their unregistered investment programs. It tallied 48 pending court cases for violations of the Securities Regulation Code.

“So far, a total of 187 individuals have been charged with violations of the SRC, with the SEC securing 17 judgments of conviction against 19 individuals meted with a total of imprisonment of 572 years and a total fine of P25 million imposed by various courts,” the regulator said.

The commission is celebrating World Investor Week, a global campaign organized by the International Organization of Securities Commissions (IOSCO). This year’s observance started Monday and will run until Oct. 10. The IOSCO program will highlight sustainable finance and efforts to curb investment fraud.

A bell-ringing ceremony for World Investor Week was held at the Philippine Stock Exchange (PSE) Wednesday.

In a separate statement, the PSE said it is also participating in a World Federation of Exchanges initiative to promote financial literacy, in support of the IOSCO program.

“All the financial literacy programs we do in PSE are our contributions to help make financial inclusion a reality. We want more Filipinos to reap the rewards of their hard work through investing,” PSE President and Chief Executive Offer Ramon S. Monzon said in a statement.

The SEC will also be hosting its own Investor Protection Week in November. — Keren Concepcion G. Valmonte

PSALM announces auction for Limay, Bataan sites

THE Power Sector Assets and Liabilities Management Corp. (PSALM) announced an auction of property in Barangay Luz and Barangay Kitang II in Limay, Bataan, setting the floor price at a combined P250.43 million.

In a statement issued late Tuesday, PSALM said that the sites are suitable for industrial and energy-related development as they are near the Limay Substation. Some portions are also suited for residential development, it added.

“These assets used to be the site of the decommissioned Bataan Thermal Power Plant and of the housing compound for the plant’s employees. Currently, there remain a few building structures and other improvements on the assets but are no longer usable unless repaired,” PSALM said.

The two Limay assets cover an estimated 139,000 square meters, divided into 14 lots. Their sale will be on an “as-is, where-is” basis.

The pre-bid conference for the property was set for Oct. 12 at 2 p.m. at PSALM’s office in Quezon City, with virtual participation available.

PSALM will be accepting bids until Nov. 5 at 2 p.m., with the opening and evaluation of bids to immediately follow.

Interested parties must pay a non-refundable participation fee of P100,000 at least two days before the bid submission deadline. Prospective bidders may download the bidding package for the Bataan assets on PSALM’s website.

Proceeds from the sale will help PSALM settle outstanding debt assumed from the National Power Corp. (Napocor)

Under the Electric Power Industry Reform Act of 2001, the wholly-owned government corporation is required to liquidate all of Napocor’s financial obligations. — Angelica Y. Yang

PH Resorts voluntarily suspends Clark resort’s PAGCOR license

PH RESORTS Group Holdings, Inc. (PHR) announced that it voluntarily suspended the Philippine Amusement and Gaming Corp. (PAGCOR) license of its Clark resort and casino due to the “lingering uncertainties” hanging over the casino industry.

In a disclosure to the exchange Wednesday, PH Resorts said it received approval from gaming regulator PAGCOR to suspend the provincial license of Clark Grand Leisure Corp. (CGLC). The company said the move was also driven by the increasing competition in its location.

PH Resorts clarified that the move will have “little to no impact” on its business operations or its finances.

“The voluntary suspension also allows PHR to ramp up and focus all efforts for the construction and development of its flagship integrated resort and casino project, the Emerald Bay Resort and Casino, located in Mactan, Cebu,” the company said.

In August, PH Resorts conducted a top-up placement to raise P600 million from the sale of 352 million shares at P1.70 apiece to qualified buyers.

The offer shares were owned by PH Resorts’ parent firm, Udenna Corp. Udenna used its proceeds to subscribe for the same number of PH Resorts primary shares for the same price to complete the private placement.

The suspension of CGLC’s provincial license will be effective until the company applies to lift the suspension, which will also require approval from PAGCOR’s board of directors. — Keren Concepcion G. Valmonte

PHL 8 months abaca output up 9.9%

ABACA PRODUCTION in the eight months to August rose 9.9% year on year to 44,796.21 metric tons (MT), according to the Philippine Fiber Industry Development Authority (PhilFIDA).

PhilFIDA Executive Director Kennedy T. Costales said in a social media post that the rise in output came despite the uncertainties of the pandemic.

The Bicol Region was the top producer of abaca fiber, accounting for 32.4% or 14,525.97 MT.

However, the abaca output of Bicol Region in the eight months declined 2.9% year on year.

The province of Catanduanes accounted for 83.8% of the regional total, with its output of 12,179.46 MT up 1.4% year on year.

Other top abaca-producing regions were the Davao Region with 19.5% or 8,728.57 MT, Caraga with 13.4% or 5,991.80 MT, and Northern Mindanao with 12.4% or 5,540.69 MT.

Abaca fiber is used in the production of specialty paper, furniture and fixtures, face masks, bags, cosmetics, and skin care products, among others.

Mr. Costales said other fibers posted production gains during the period.

Coir, or coconut fiber, production rose 35.5% to 14,630.88 MT. Davao Region accounted for 62.8% or 9,181.88 MT of the national total.

Production of raffia, a palm fiber, rose 49.7% year on year in the eight months to August to 26.85 MT. Bohol accounted for 51.4% or 13.79 MT of total output.

Output of Salago, whose fibers are made into rope, paper and resin, rose 26.1% to 165 MT. Cebu accounted for 47% or 77.63 MT of total production.

Piña fiber output for the period increased 270.5% to 14.3 MT. South Cotabato accounted for 96.6% or 13.82 MT of overall production.

Production of musa, of the banana family, rose 13.9% to 1,052.50 MT. Camarines Sur was the top producer with 47.5% or 499.50 MT of the total. — Revin Mikhael D. Ochave

The price of letting go: Revisiting donor’s tax

One of the basic tenets to achieving a sound taxing system is theoretical justice. In principle, theoretical justice dictates that tax laws should be equitable, that is, they should be based on the taxpayer’s ability to pay. In other words, those who have more should be taxed more. However, this principle is not at all times applicable; for instance, a person who is supposed to receive a property out of the estate of a deceased may end up overdrawn or indebted to the government for waiving his right to a part of his inheritance.

This situation is discussed in Revenue Memorandum Circular (RMC) No. 94-2021 dated July 21 which was issued by the Bureau of Internal Revenue on Aug. 10, clarifying the donor’s tax treatment of an heir’s renunciation of his share from the specific property forming part of the estate of the decedent. While the RMC acknowledges the donor’s tax exemption of the general renunciation of an heir of his inheritance, it also introduces us to the concept of partial renunciation. This can happen when an heir agrees to receive a specific property valued at an amount lower than the value of what should have been his rightful share had all the properties of the decedent been distributed. There is partial renunciation/waiver because an heir is letting go of his share to identified properties only and not his entire share from the estate.

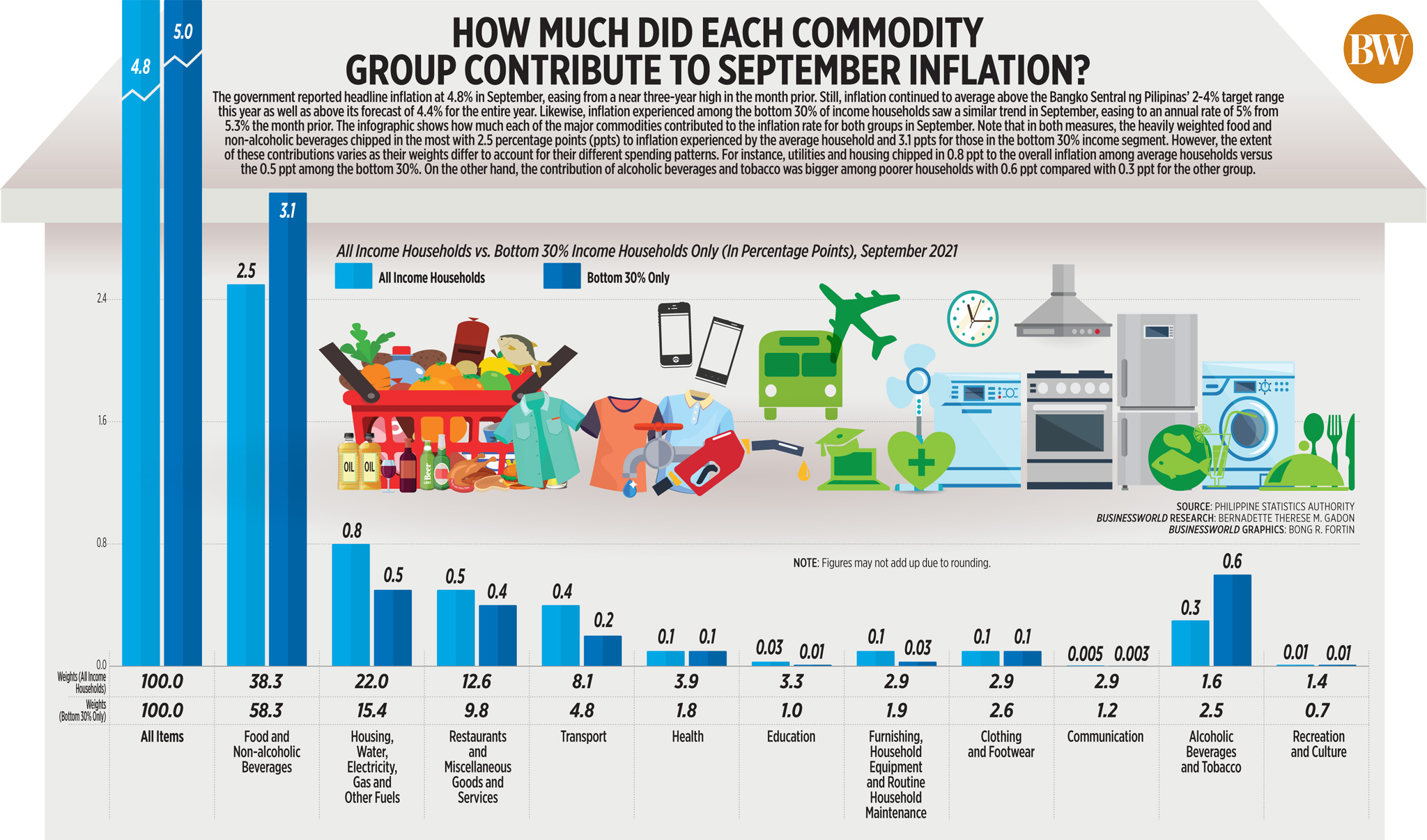

As an illustration, let us assume that a decedent left three real properties to three heirs, with the following zonal values (assuming that these are higher than the fair market values per tax declaration): Property 1 — P4,500,000; Property 2 — P6,000,000; and Property 3 — P3,000,000. Assuming further that all three heirs are entitled to an equal share of the estate, i.e., each one should get a third of all three properties. Thus, each heir should be receiving P4.5 million in value, computed as follows:

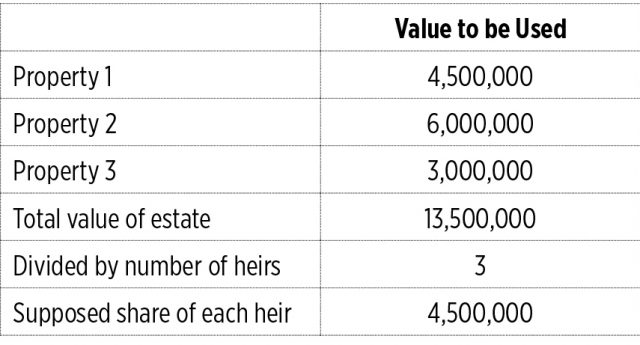

However, suppose the heirs agreed among themselves to split their inheritance so that each one renounces his share in the other two properties and receives only one of the three properties. Accordingly, one heir would be subject to a donor’s tax of P75,000 on the value foregone as a result of the partial renunciation, as computed on the table below:

As shown in the computation, the RMC seeks to clarify that the difference between the value of the supposed share of each heir out of the total estate and the value of the specific property received as a result of the partial renunciation is a donation subject to 6% donor’s tax to the extent that it exceeds the P250,000 tax-exempt amount. To some, it would appear that the burden of paying the tax due was shifted to the person who received the least valued property out of the total estate, contradicting the principle of theoretical justice. Imagine yourself letting go of a portion of your supposed property free of charge, resulting in a diminution in the value of your rightful share, but winding up subject to more tax liabilities.

However, unlike income tax which is based on the income received by a person, donor’s tax is imposed on the liberality of the transferor to dispose freely of an identified property as a gift in favor of another, whether directly or indirectly. While the circular imposes the tax burden on the person who receives a lesser share of what he is entitled to, the tax is really on that person’s waiver of his right over a particular property or a fraction of the entire estate. Thus, the seeming irony behind the imposition of the donor’s tax on such waiver is best explained in this wise: The person who renounces his rights as to a particular share out of the entire property of the decedent, in reality, is the one who has the most resources signifying an ability and the means to pay taxes. Consider also that the partial renunciation is done voluntarily so that a bigger share may be available for distribution to the other heirs, thereby waiving the donor’s right to receive the remainder. Such waiver suggests knowledge and intention to relinquish a particular right. Hence, the donor not only has the means but is fully cognizant of the consequences of his decision.

The flexibility of our tax system is evident in this circular’s recognition that donation comes in many forms — whether in an act of giving or a mere waiving of a right. Persons who exercise the privilege to transfer a property to another, directly or indirectly, bear the tax consequences. In other words, gratuity comes with a cost. Theoretical justice should not only be understood as imposing taxes on taxpayers with more income. Instead, equitability dictates that those in better circumstances should assume greater tax liabilities.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The content is for general information purposes only, and should not be used as a substitute for specific advice.

Mary Rose Lara is an assistant manager at the Tax Services Department of Isla Lipana & Co., a Philippine member firm of the PwC network.

+63 (2) 845-2728

Probe of ‘hijacked’ SMS alert on Marcos sought

By Kyle Aristophere T. Atienza, Reporter

and Alyssa Nicole O. Tan

SOME mobile phone users received an emergency text message from the telecommunication regulator endorsing the presidential run of the late dictator Ferdinand E. Marcos’s only son and namesake on Wednesday, just as he filed his certificate of candidacy.

“A solid concern for the country, a life devoted to the people” the alert written in Filipino that featured the initials of Ferdinand “Bongbong” R. Marcos, Jr. or BBM read. “BBM for the nation, BBM for the people, BBM for the masses, BBM for the Philippines.”

The National Telecommunications Commission (NTC) will investigate the matter, Deputy Commissioner Edgardo V. Cabarios said in a Viber message.

Under the law, the local disaster agency and telecommunication companies must issue emergency warnings during calamities such as typhoons and earthquakes.

The National Disaster Risk Reduction and Management Council did not send the endorsement, the Philippine Star reported, citing spokesman Mark Timbal.

“We support the swift action of the NTC calling for an investigation of the illegal use of the emergency alert notification text containing pro-Bongbong Marcos narratives,” Marcos chief of staff Victor Rodriguez said in an e-mailed statement.

Party-list group Bayan Muna urged the Department of Information and Communications Technology (DICT) to “immediately investigate and explain how the Marcos campaign was able to hijack the emergency alert frequency.”

“This casts a serious doubt on the integrity of the system, which people are supposed to rely on for life-saving information,” it said in a statement. “Aside from the NTC and DICT, Congress should also probe this underhanded style of campaigning.”

Mr. Marcos, a former senator, filed his certificate of candidacy for President under the Partido Federal ng Pilipinas, which was founded by allies of President Rodrigo R. Duterte.

“I filed my certificate of candidacy for president just now,” he told reporters. “I guess that makes it official.”

Mr. Marcos said his party had planned to adopt Mr. Duterte, who had expressed his admiration for the late dictator, as his running mate.

Last week, Mr. Duterte said he would retire from politics when his six-year term ends next year. He added that he had backed out of his vice-presidential ambition because his daughter Davao City Mayor Sara Duterte-Carpio would run for President in tandem with Senator Christopher Lawrence “Bong” T. Go, his former aide.

“With what happened on Saturday, all our plans changed,” Mr. Marcos said. So now, we are making consultations.”

Mr. Marcos said his talks with Ms. Carpio, “never reached specifics,” adding that he would consider Mr. Go as his running mate.

Senator Panfilo M. Lacson, the first mainstream politician to announce a presidential run, also filed his certificate of candidacy under Partido Reporma, with Senate President Vicente C. Sotto III as his running mate. Mr. Sotto is running under the Nacionalista Party.

Mr. Lacson, a former police chief who served in the now defunct Philippine Constabulary, lost to ex-President Gloria Macapagal Arroyo in the 2004 elections.

The 73-year-old senator had faced murder charges after policemen under his command shot and killed 11 members of a crime syndicate during a raid in Quezon City in 1995. The Supreme Court acquitted him in 2012 for lack of probable cause.

Vice-President Maria Leonor “Leni” G. Robredo, who has been endorsed by an opposition coalition as its presidential candidate for the 2022 elections, had been in talks with Mr. Lacson as part of her efforts to form a united opposition.

Mr. Lacson had rejected a nomination by 1Sambayan, noting that many of its members were plaintiffs in a Supreme Court lawsuit questioning the Anti-Terrorism Act, which he authored.

Labor leader Leodegario “Leody” de Guzman also filed his candidacy certificate for president. He ran for senator in 2019 and lost.

Meanwhile, former Public Works Secretary Mark A. Villar filed his candidacy certificate for senator under the Nacionalista Party.

Senators Juan Miguel F. Zubiri and Emmanuel Joel J. Villanueva also filed for reelection.

Former Philippine Medical Association President Leo O. Olarte and actor and ex-Quezon City Mayor Herbert Bautista likewise filed their certificates of candidacy for senator.