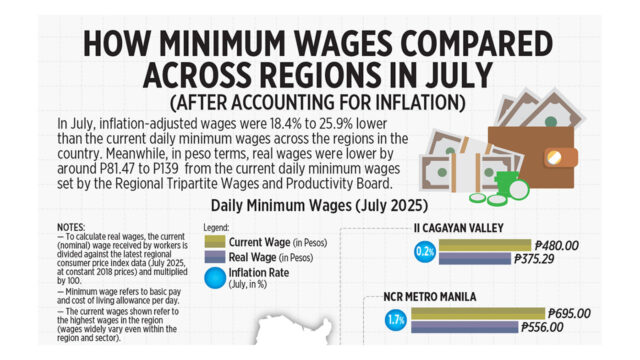

How minimum wages compared across regions in July

(After accounting for inflation)

In July, inflation-adjusted wages were 18.4% to 25.9% lower than the current daily minimum wages across the regions in the country. Meanwhile, in peso terms, real wages were lower by around P81.47 to P139 from the current daily minimum wages set by the Regional Tripartite Wages and Productivity Board.

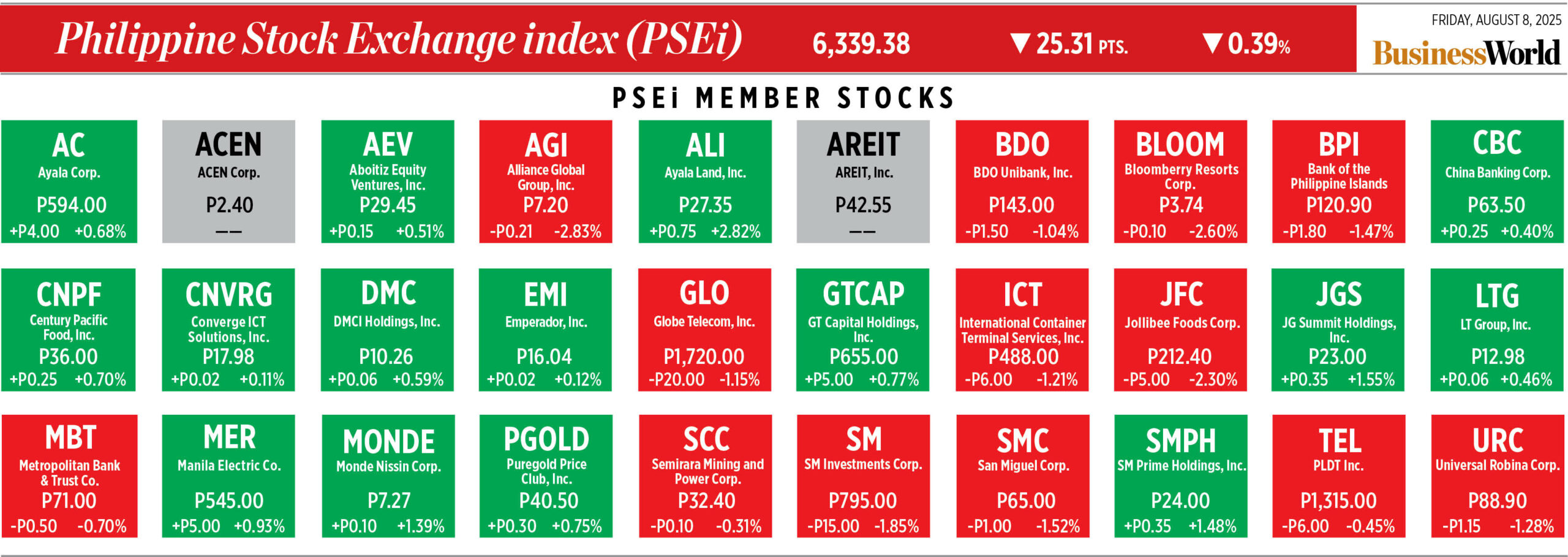

Stocks to move sideways as market seeks leads

PHILIPPINE SHARES may continue to move sideways as investors search for fresh catalysts, including tariff policy announcements from the Trump administration and listed companies’ financial results.

On Friday, the Philippine Stock Exchange index (PSEi) dropped by 0.39% or 25.31 points to close at 6,339.38, while the broader all shares index fell by 0.22% or 8.65 points to 3,767.41.

Week on week, the PSEi climbed by 0.53% or 33.25 points from its 6,306.13 finish on Aug. 1.

“The PSEi went sideways this week as investors weighed the lift from the second quarter gross domestic product (GDP) and cooling July inflation against global policy uncertainties and potential third quarter growth risks,” online brokerage 2TradeAsia.com said in a market note.

“For the past nine weeks, the local market has been moving alternately between gains and losses. The lack of clear direction reflects investors’ indecisiveness as they continue to weigh mixed factors from prospects of further policy easing by the BSP (Bangko Sentral ng Pilipinas), risks and uncertainties on the US’ protectionist trade policies, and the overall status of the general economy,” Philstocks Financial Inc. Research Manager Japhet Louis O. Tantiangco said in a Viber message.

Philippine GDP expanded by 5.5% in the April-to-June period, slightly faster than the 5.4% growth in the first quarter but slower than the 6.5% expansion in the second quarter last year. This matched the lower end of the government’s 5.5%-6.5% growth target for this year.

For the first half, GDP growth averaged 5.4%, slightly below the government’s goal.

Meanwhile, Philippine inflation slowed to a near six-year low of 0.9% in July from 1.4% in June and the 4.4% print in the same month a year ago. This marked the fifth straight month that it settled below the central bank’s 2-4% target.

Year to date, the consumer price index averaged 1.7%, slightly higher than the BSP’s 1.6% full-year forecast.

For this week, Mr. Tantiangco said the market will look for leads.

“Investors are expected to watch out for updates regarding US President Donald J. Trump’s trade policy plans, primarily on his chips and semiconductor tariffs. Investors are also expected to continue monitoring second quarter corporate reports,” he said. “Prospects of further easing by the BSP following supportive economic data this past week may continue to give the market support.”

“Chart-wise, based on its performance from mid-July to present, the local market is still bearishly biased. To negate this trend, the market must first go above its most recent low (6,222.04 last July 31) and most recent high (6,466.10 last July 24),” he added.

2TradeAsia.com put the PSEi’s immediate support at 6,300 and resistance at 6,600.

“The ongoing second quarter earnings season will serve as a critical period for validating fundamental theses, which have shifted amidst evolving macroeconomic pressures,” it said. — Revin Mikhael D. Ochave

Mangroves: Natural Guardians of Quezon’s Coastline

by Edg Adrian A. Eva, Reporter

In Barangay Alitas in Infanta, Quezon Province, where saltwater and freshwater quietly converge, trees with roots rising from the shallows dominate the landscape. These salt-tolerant trees, known as mangroves—or bakauan in Filipino—have long sustained the community with food, protection, and resilience.

For Sherwin P. Aveno, a 36-year-old rice farmer and part-time fisherman, mangroves are more than just trees. As president of the Alitas Farmers and Fisherfolk Association Inc. (AFFAI), he believes that mangroves are a lifeline for their community.

“Mangroves help us because they become breeding grounds for fish,” Mr. Aveno said in Filipino, emphasizing the importance of mangroves to their daily catch.

Forester Thaddeus C. Martinez, Manager of the Natural Resources Management Department at Haribon Foundation, AFFAI’s partner environmental organization, told BusinessWorld that mangroves are a nature-based solution to climate change due to their ability to capture and store up to five times more carbon than terrestrial trees.

“Carbon absorption in a mangrove forest is bigger. Why? Because it’s also in the soil, the mangrove area’s capacity to sequester carbon,” Mr. Martinez said in mixed English and Filipino.

“There is more carbon stored in the soil. So, it’s a combination of the tree’s functions and the soil.”

He added that they also serve as a habitat for various species of fish and crustaceans, which provide a source of livelihood for the community.

“So, if there are no mangroves, how will they multiply? That’s one of the basics, but sometimes, many people don’t appreciate this,” Mr. Martinez said.

A 2012 report by The Environmental Law Alliance Worldwide (ELAW) shows that mangroves can significantly reduce the height of wind and swell waves by 13% to 66% over a distance of just 100 meters.

“When a typhoon hits, instead of experiencing the full force of a Signal No. 3 storm warning—which indicates destructive winds—we feel a weaker impact,” Mr. Aveno said.

Human threat

Like other wildlife, Mr. Martinez said, mangroves are also not spared from threats caused by human activity.

Mangroves are cut down to be used for furniture and other household items, or as fuel wood.

Before the restoration efforts began, Mr. Aveno said that his fellow fisherfolk were cutting down mangrove trees to create pools for fish farming.

A report from the Climate Change Commission said that the Philippines has already lost a vast portion of its mangrove forest cover over the past century.

From an estimated 450,000 hectares in 1920, mangrove coverage declined to 317,500 hectares by 1990, and further decreased to 311,400 hectares in the most recent statistics.

It added that the conservation of the remaining mangrove forests is crucial, as they play a vital role in coastal protection, biodiversity conservation, and carbon sequestration.

To reverse decades of degradation, restoration efforts are now underway—led by both local communities and corporate partners.

Manulife and Haribon’s mangrove restoration initiative

To help protect and expand the country’s mangrove forests, Manulife Philippines, the local arm of one of the world’s leading financial services providers, has launched a mangrove restoration initiative with the Haribon Foundation on May 30.

The expanded partnership aims to plant more than 15,000 mangrove seedlings across various sites in Quezon Province over the next three years.

Since 2022, they have also collaborated to plant over 21,250 native trees in the Sierra Madre mountain range.

This time, the effort has expanded to the seashore, underscoring Manulife’s Impact Agenda commitments to accelerate a sustainable future, as well as Haribon’s ‘Forest for Life’ conservation campaign.

“We will be going into the back roads and doing the seed plantation ourselves. Hopefully, with these small actions, we can create some interest and willingness to take action on these very important issues in the wider community,” Rahul Hora, President and Chief Executive Officer of Manulife Philippines, said during the launch event.

Meanwhile, Haribon Foundation’s Chief Operating Officer, Arlie Endonila, expressed her appreciation for the recent expanded partnership with Manulife.

“I’ve read through Manulife’s Impact Agenda. It is truly amazing how it aligns with Haribon’s vision and mission, especially in ensuring not only a healthy environment but also the well-being of the communities,” Ms. Endonila said.

After the launch, BusinessWorld and other media members were invited to see and be involved in the mangrove restoration project.

During that time, Haribon led the planting of over 100 seedlings in the area managed by the Alitas Farmers and Fisherfolk Association Inc. (AFFAI).

Ken Carlo Peñaflor, a forester from the Haribon Foundation, said that restoring a mangrove forest is a long and meticulous process.

Two mangrove species commonly found in the area each require specific tidal conditions to survive and flourish.

The Tall-stilt Mangrove, locally known as Bakauan-lalaki, is ideally planted in the inner or landward zones.

Meanwhile, the Asiatic Mangrove, or Loop-root Mangrove, locally called Bakauan-babae, thrives in the outer zones closer to the shore.

Mangrove restoration process

Mangrove restoration process

Mangrove life begins in a nursery, where seedlings are nurtured in a controlled environment for 6 to 8 months to ensure they are ready for planting.

Once ready, the seedlings are planted in areas that have been denuded or damaged due to human activity or strong typhoons.

Mangroves are expected to become partially viable, or begin capturing carbon, by the time they reach the sapling stage, which is around three years old.

Mangroves typically mature between 5 to 10 years, with an overall lifespan ranging from 20 to 100 years.

Mr. Martinez gladly said that mangroves planted at sites in Alitas have a high survival rate of 85%, sometimes even reaching 92%.

He expressed optimism that the initiative will be sustainable due to the support of the community, along with Manulife’s long-term commitment.

Mr. Hora assured that Manulife’s commitment to the restoration initiative is long-term and goes beyond just planting seeds.

The company will continue to support Haribon and the community until the mangroves become viable.

Mr. Hora added that they also plan to expand the initiative to other areas of the country.

“This is just the beginning. We want to continue working with Haribon,” Mr. Hora said.

“This is just the beginning. We want to continue working with Haribon,” Mr. Hora said.

“We will sustain our efforts because we truly believe in what we are doing. So, yes, we will also continue to focus on other areas of the country.”

For fisherman Mr. Aveno, initiatives like this are warmly welcomed by the community, as they could spark the growth of other industries, such as eco-tourism, which has already started and is providing new jobs now for the community.

Meralco seeks DoE approval for 900-MW baseload procurement

POWER distributor Manila Electric Co. (Meralco) is seeking to procure 900 megawatts (MW) of electricity via a competitive selection process (CSP).

It currently has three other CSP applications pending.

“There is another one coming in — a 900-MW baseload CSP,” according to Meralco Senior Vice-President and Head of Regulatory Affairs Jose Ronald V. Valles.

Mr. Valles said the auction is scheduled for late 2025.

The proposed CSP forms part of Meralco’s 2025 power supply procurement plan to obtain over 2,100 MW of capacity, which has been approved by the Department of Energy (DoE).

The CSP policy requires distribution utilities to procure power at a least-cost basis.

Meralco has requested DoE certificates of compliance for the three other CSPs, involving 200 MW of renewable energy baseload power, 600 MW worth of baseload, and 450 MW worth of mid-merit power.

Baseload power plants generate a steady supply of electricity to meet regular demand, while mid-merit plants are designed to operate during periods of intermediate demand.

“There is another one in the pipeline but we are still waiting for the resolution of the DoE with respect to these three CSPs because these are more urgent in terms of the commercial operations date that we are looking at for the distribution utility,” Mr. Valles said.

He said that Meralco’s application for the 200-MW CSP is now under review after the power distributor submitted its reply on the comments of the Philippine Competition Commission (PCC) and the Energy Regulatory Commission.

The company has yet to receive the review of the ERC and PCC for its 600-MW and 450-MW CSPs.

In a statement on Sunday, Meralco confirmed receipt of the show-cause order issued by the Energy Regulatory Commission (ERC) for alleged failure to submit complete fuel data for the January to October 2022 period.

The order stems from the ERC’s request in January 2023 for documents related to the power supply agreement (PSA) between Meralco and Panay Energy Development Corp. (PEDC).

The ERC required submission of invoices and fuel cost computation for the period.

“As ERC’s directive was for the declared purpose of verifying generation charges ‘being passed on to its consumers,’ Meralco complied and provided ERC with copies of the invoices for its then existing PSA with PEDC — notwithstanding that these documents had already been previously submitted under Meralco’s regular reports to ERC,” the company said.

For the fuel cost computation, Meralco said that it clarified that its then PSA with PEDC was a financial contract with a fixed price or single tariff for the duration of the contract term.

“This means that it does not specify any fuel cost component, in contrast to a two-part tariff that distinguishes fixed costs from fuel costs on a monthly basis. Given this, the fuel cost computation was obviously not applicable,” the company said.

Following Meralco’s submission in 2023, the company said it did not receive any further communication from the ERC.

“At the outset, Meralco emphasizes that it does not only validate but scrutinizes the fuel components of the generation charges before these are passed through to its consumers,” the company said.

Meralco’s controlling stakeholder, Beacon Electric Asset Holdings, Inc., is partly owned by PLDT Inc.

Hastings Holdings, Inc., a unit of PLDT Beneficial Trust Fund subsidiary MediaQuest Holdings, Inc., has an interest in BusinessWorld through the Philippine Star Group, which it controls. — Sheldeen Joy Talavera

BSP launches SME credit risk database

THE Bangko Sentral ng Pilipinas (BSP) has launched a credit risk database with a web-based scoring system which will allow financial institutions to evaluate small businesses and boost credit access.

“It aims to enhance access to credit of small and medium enterprises (SMEs) by helping financial institutions (FIs) assess the creditworthiness of their SME borrowers, creating a truly inclusive economy,” the BSP said in a memorandum on its website.

The Credit Risk Database Philippines Web-based Scoring System (CRDPh System) is an automated platform designed to streamline the secured submission and processing of data and retrieval of credit risk database outputs.

It transitioned to a web-based platform from the previous standalone CRD scoring tool.

“By complementing existing models and tools, the CRDPh System expects to enhance the FIs’ credit risk-based evaluation of SME borrowers, address information asymmetry, improve loan pricing, reduce dependence on collateral, and ultimately support access to finance of SMEs.”

Banks continued to miss the lending quota for small businesses at the end of March, extending just P546.82 billion to micro, small and medium enterprises (MSMEs), equivalent to 4.63% of their total loan portfolio of P11.82 trillion.

This fell short of the 10% overall requirement under the Magna Carta for MSMEs. Under the law, banks must allocate 8% of their loan portfolio to micro and small enterprises, and 2% to medium-sized businesses.

For years, most banks have opted to incur penalties for noncompliance with the lending quota instead of taking on the risk associated with lending to small businesses.

Analysts have attributed the failure to meet the lending quotas to the dearth of credit information on these types of borrowers.

The first phase of the project, which was launched in 2020, covered the construction of the database of SME data; the development and validation of the scoring model; and the deployment to pioneer FIs.

“The ongoing Phase 2 of the CRD project will support the development of new CRD services and a transition plan toward a sustainable, permanent operation beyond the project-based phase,” it added.

The CRDPh System was primarily developed to “facilitate transition of CRD from project-based to sustainable operation.”

“Once additional services are developed, the CRDPh System will also provide FIs with statistical information on SMEs which will be useful in understanding trends and patterns in the SME sector and formulation of business strategies.”

Additional services include comparison of CRD outputs with the FI’s internal rating/score, consultancy service for/analysis of FIs’ SME client, and statistical information.

“Furthermore, the CRDPh System is envisioned to encourage FIs to efficiently manage SME data as they are required to periodically submit SME data to continuously enhance the CRD database,” it said.

The project is a joint initiative with the Japan International Cooperation Agency.

There are a total of 33 pioneer financial institutions currently participating in the project. These are institutions that voluntarily shared data for the construction of the CRD database and scoring model.

“On the other hand, participating FIs are FIs which will utilize and access the CRDPh System to generate CRD outputs and periodically submit data. Thus, participating FIs are considered as both data contributors and users of the CRD scoring model.”

The Philippines is also the first country to adopt the CRD outside Japan, it added.

“CRD is a large-scale database of anonymized financial, non-financial and borrower performance-related (due dates and past due status) data of small and medium enterprises (SME) provided by pioneer FIs from which a statistical credit scoring model was developed.”

The scoring model can generate the probability of default and credit score output of an SME borrower in a particular group of similar attributes, as data is anonymized, the BSP said.

CRD outputs can be used to assess the capacity of SMEs to repay loans, validate or develop internal rating systems, and align pricing decisions or strategies with borrowers’ credit risk profile. — Luisa Maria Jacinta C. Jocson

GOCC subsidies fall nearly 27% in June

SUBSIDIES provided to government-owned and -controlled corporations (GOCCs) fell 26.68% from a year earlier in June, the Bureau of the Treasury (BTr) reported.

The BTr said budgetary support to GOCCs was P7.45 billion in June, against P10.16 billion a year earlier.

Month on month, GOCC subsidies fell 5.90% from P7.92 billion in May.

State-owned firms receive monthly subsidies from the National Government to support their daily operations if their revenue is insufficient.

In June, the National Food Authority (NFA) topped the subsidy list with P3.43 billion or 46.07% of the total. It received no subsidies in February and March.

This was followed by the National Irrigation Administration (NIA), which received P2.39 billion.

The Philippine Fisheries Development Authority was granted P268 million in subsidies in June.

State-run firms on the subsidy list included the Philippine Heart Center (P184 million), the Philippine Coconut Authority (P165 million), the National Kidney and Transplant Institute (P124 million), the Philippine Children’s Medical Center (P114 million), and the National Power Corp. (P106 million).

Other GOCCs obtaining subsidies of less than P100 million include the Philippine Rice Research Institute (P96 million), the Subic Bay Metropolitan Authority (P86 million), the National Dairy Authority (P75 million), the Light Rail Transit Authority (P74 million), and the Philippine National Railways (P72 million).

Those receiving less than P50 million were the Lung Center of the Philippines (P49 million), the Development Academy of the Philippines (P40 million), the Cultural Center of the Philippines (P34 million), the Philippine Institute of Traditional and Alternative Health Care (P29 million),the Center for International Trade Expositions and Missions (P20 million), the People’s Television Network, Inc. (P18 million), the Metropolitan Waterworks and Sewerage System (P14 million) and the Sugar Regulatory Administration (P11 million).

Also in this tier were the Aurora Pacific Economic Zone and Freeport Authority (P10 million), the Philippine Institute of Traditional and Alternative Health Care (P8 million), the Southern Philippines Development Authority (P7 million), the Philippine Tax Academy (P5 million), the Philippine Center for Economic Development (P5 million), and the Zamboanga City Special Economic Zone Authority (P4 million).

Receiving no subsidies were the Land Bank of the Philippines, the Small Business Corp., the National Electrification Administration, the National Housing Authority, the Bases Conversion Development Authority, the Intercontinental Broadcasting Corp.-13, the Philippine Crop Insurance Corp., the Power Sector Assets and Liabilities Management Corp., the Tourism Infrastructure & Enterprise Zone Authority and the Tourism Promotions Board.

In the first six months, GOCC subsidies totaled P52.50 billion, down 21.89%.

The NIA was the top recipient during the period with P17.73 billion. This was followed by PSALM (P8 billion) and the NFA (P7.18 billion).

As of July, the Department of Finance had collected P105 billion in GOCC dividends. — Aubrey Rose A. Inosante

PHL export data to start reflecting tariff impact after 1st half boosted by frontloaded shipments

THE GROWTH in Philippine exports seen in the first half could start slowing down beginning in early August after the 19% US reciprocal tariff took effect, an analyst said.

Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort said there was some frontloading of exports in recent months to avoid the US tariffs.

“But once the US tariffs become effective on Aug. 7, this could slow exports to the US by many countries,” he said via Viber.

Preliminary data from the Philippine Statistics Authority indicate that exports grew 13.2% in the first half to $41.24 billion.

Of the total, 16%, or $6.598 billion, was accounted for by the US. US shipments rose 13.2% from a year earlier.

In a recent trade forecast, the World Trade Organization (WTO) said that a surge of imports in the US ahead of widely anticipated tariff hikes contributed to the upward revision to the projections for 2025.

Starting Aug. 8, the WTO projects world merchandise trade to grow 0.9% in 2025, up from the -0.2% projected in April.

“Global trade has shown resilience in the face of persistent shocks, including recent tariff hikes. Frontloaded imports and improved macroeconomic conditions have provided a modest lift to the 2025 outlook,” WTO Director-General Ngozi Okonjo-Iweala said.

“However, the full impact of recent tariff measures is still unfolding. The shadow of tariff uncertainty continues to weigh heavily on business confidence, investment, and supply chains. Uncertainty remains one of the most disruptive forces in the global trading environment,” she added.

For next year, the WTO projects a 1.8% increase in world trade.

Despite the temporary boost of frontloading and more favorable global macroeconomic outlook on trade, the WTO still expects recent tariff changes to have an overall negative impact.

“This stems from a combination of factors. On the one hand, the US-China truce and exemptions for motor vehicles are contributing positively,” the WTO said.

“On the other hand, higher ‘reciprocal’ tariff rates introduced on Aug. 7 are expected to weigh increasingly on imports in the United States and depress exports of its trading partners in the second half of 2025 and in 2026,” it added.

Mr. Ricafort said Philippine exports are around three to five times smaller compared to those of other Association of Southeast Asian Nations (ASEAN) countries, insulating it from the tariff impact.

“The Philippine economy is not that export dependent and lately domestically driven, wherein about 70% of the economy was accounted for by consumer spending,” he said.

“The markets are still in a wait-and-see mode if Trump would be willing to compromise and settle for lower negotiated tariffs during the trade negotiations, given the TACO track record in recent months,” he added, referring to the “Trump Always Chickens Out” investment thesis being peddled by market traders.

The TACO thesis holds that Mr. Trump usually issues threats at the start of negotiations, then backs off later.

Despite this, Mr. Ricafort said the Philippines needs to diversify its export markets to other affluent markets.

“It is also better to diversify export winners beyond electronics, like agricultural export winners such as coconut oil, bananas, pineapples, mangoes, other tropical fruits, tuna, other seafood, or marine products,” he added.

Economic affairs officers Rajan Sudesh Ratna and Jing Huang of the UN Economic and Social Commission for Asia and the Pacific (ESCAP) are projecting that the US tariffs will reduce ASEAN exports to the US.

According to their report, “the higher tariffs will reduce China’s competitiveness and prompt global buyers to seek alternative suppliers, both reducing demand and redirecting trade flows.”

However, it said ASEAN countries will benefit from this shift, “gaining market share as trade is diverted away from China.”

“All ASEAN member countries gain purely through trade diversion rather than trade creation, indicating that while overall demand remains unchanged, supply sources are shifting,” it said.

“ASEAN’s ability to absorb trade diverted from China demonstrates the importance of flexible supply chains and open trade policies,” it added.

However, they said ASEAN must explore alternate markets beyond China, as their exports “may face challenges due to increased costs associated with tariffs, especially if their exports are levied duties for China.”

To address these challenges, they recommended that bloc members increase intra-ASEAN trade.

“Strengthening intra-regional trade through harmonization of regulations and reduction of tariffs among member states will create a more robust internal market within ASEAN itself and prevent them from absorbing the external shock emanating from the additional US tariffs,” they said.

They said ASEAN should adopt a collective approach to enhancing bargaining power in negotiations with external partners to reduce reliance on the US market.

They added that “ASEAN can capitalize on the shifting trade dynamics by promoting bilateral and regional economic partnerships with China.”

Another recommendation is for ASEAN to look into market diversification, focusing on countries with which it has free trade agreements (FTAs), and to actively pursue new FTAs.

They also recommended a focus on services trade and the adoption of digital policies.

“With the US reciprocal tariffs imposed across the board on almost all countries with higher duties on China, some of the supply chain linkages of ASEAN members are likely to be disrupted,” they said.

“ASEAN must formulate an alternate export strategy. In this regard, looking at other important markets, focusing on services trade by including it in its FTAs, entering into FTAs with other major trading partners, and discussing how to enhance intra-ASEAN trade are some of the options,” they added. — Justine Irish D. Tabile

LPG licensing services expand to Palawan

THE Department of Energy (DoE) said it will conduct a five-day session with the liquefied petroleum gas (LPG) industry to outline the licensing process in Palawan.

“By delivering services directly to the people, we are strengthening safety standards while helping local enterprises operate more efficiently and competitively,” Energy Undersecretary Alessandro O. Sales said in a statement on Sunday.

During the activity, scheduled to run until Aug. 15, the DoE will provide same-day processing to enable retailers, dealers and gasoline station owners in the island province to secure their license to operate (LTOs) and certificate of compliance.

Applicants must prepare and present complete documentation to qualify for same-day processing.

The DoE said that it will expand the initiative to islands and remote provinces to ensure that the services reach underserved areas.

In the recent years, LPG dealers from the provinces have had to travel to the DoE Central Office in Taguig City to submit and process applications.

By taking licensing services to the regions, the DoE aims to reduce travel costs and lost business time, encourage wider compliance, and make regulatory processes more accessible to smaller operators.

The One-Stop Shop complies with the LPG Industry Regulation Act (LIRA) and related DoE issuances, which require operators to obtain licenses and certifications from the DoE and other agencies.

The DoE said these requirements ensure adherence to health, safety, security, environmental, and quality standards applicable to the LPG and liquid fuels industries.

As of June, the DoE has issued LTOs to 14,672 LPG facilities nationwide. — Sheldeen Joy Talavera

DTI imposes 200-day provisional safeguard measures on corrugating medium imports

THE Department of Trade and Industry (DTI) is imposing a provisional safeguard measure of P3,438 per metric ton (MT) on imports of corrugating medium, effective for 200 days.

In an order, the DTI said the preliminary investigation found a “causal link between the increased imports of the products under consideration and serious injury to the domestic industry.”

“The increased volume of imports, both in absolute terms and relative to domestic production, was found to be the substantial cause of the overall impairment in the operations of the local industry,” it added.

Made from a high percentage of recycled paper, corrugating medium is used in corrugated box packaging.

The DTI is acting on a petition filed by the Pulp and Paper Manufacturers Association of the Phils. (PULPAPEL), which accounts for 90% of the total domestic production of corrugating medium.

According to the DTI’s preliminary report, imports of corrugating medium significantly increased between 2019 and 2023.

“Over the period of investigation, the volume of imports grew by approximately 71%… In 2023, imports rose to 99,671 MT,” it said.

“In 2024, imports increased further by 28% compared to 2023, marking the highest level during the period. The 2024 import volume is also 1.71 times higher than the 2019 pre-pandemic level,” it added.

According to the DTI, this reflects a recent, sudden, sharp, and significant increase in imports in absolute terms.

The biggest suppliers of corrugating medium are Japan, Indonesia, Australia, Vietnam, and China.

Last year, Japan accounted for a 54.52% share of total Philippine imports, or 69,713 MT, followed by PROC (32.55%), Vietnam (4.97%), and Indonesia (4%).

During the period, the DTI said the share of imports represented a significant share in proportion to production.

“While domestic production slightly increased, imports grew at a significantly faster rate, outpacing production growth. In 2024, the share of imports relative to domestic production increased further,” it said.

The investigation also showed price depressions of 14.78% and 12.83% in the last two years and a price suppression of 1.62% in 2024.

“The condition of competition shows that the market share of locally produced corrugating medium was essentially displaced during the investigation as the share of imports in the Philippine market significantly increased,” the DTI said.

It said the industry suffered loss of market share, declining utilization, reduction in employment, and incurred losses.

“If the surge in imports continues, local industry will lose market share to cheaper imported products. Without the corrugating medium industry, consistency and availability of local supply will be imperiled,” it added.

The safeguard measure on imports of corrugating medium covers ASEAN Harmonized Tariff Nomenclature Codes 4805.19.90 and 4805.12.00 will take effect after the issuance of the relevant Customs Memorandum Order/Circular.

It does not apply to imports originating from developing countries, the DTI said. — Justine Irish D. Tabile

Penshoppe group banking on automated distribution

By Justine Irish D. Tabile, Reporter

FASHION RETAILER Golden ABC, Inc., which trades under the Penshoppe brand, said it is banking on an automated distribution operation to support the growth of its bricks-and-mortar stores.

Bryan Liu, vice-president for strategy and operations at Golden ABC, said: “In the past few years, one of our biggest changes was the way we operate our back end. So we invested in a huge and highly automated distribution center,” he said.

“There are robotics, and there are things in play in that facility that will make us more efficient and allow us to serve our stores and customers better,” he added.

He added that the pandemic pushed the company to improve coordination across the end-to-end value chain to be a lot more efficient and serve customers a lot better.

“Very recently, we also really spent a lot more time revisiting how we develop our products. We have invested a lot more time and effort in how we develop our products, our brands, and our stores,” he added.

He also said that artificial intelligence (AI) is one of the initiatives driving the company today.

“Given that our vision is to be a more AI-driven company. We are really focusing a lot on our data, and the way that we collect, structure, store, and consume data is now a big part of how we operate in the company,” he added.

Golden ABC is also the company behind brands such as OXGN, Forme, Memo, Regatta, and BOCU.

Brandon Liu, newly appointed vice-president for Penshoppe, said in a statement “We’ve built Penshoppe to resonate globally while staying rooted in Filipino identity.”

“As we move forward, our focus is to remain as relevant as ever — and to keep delivering what our customers expect from us as a market leader: on-trend fashion, culturally attuned collaborations, and brand experiences that are both globally competitive and uniquely our own,” he said.

He said the company is always on the lookout for what its customers need.

“Our success in the past few years has also been attributed to being able to stay relevant to the consumer; otherwise, we might not be as good in terms of the position we are in now,” he added.

He said Penshoppe currently caters to a young demographic, “but we are trying to challenge that, in the sense that it is not just targeting the youth but really people who are looking for great value products at affordable pricing.”

“We are leading it back to the brand values and what we stand for. I don’t want to box it in terms of demographics; it actually depends on where you are in life as well,” he added.

Looking forward, he said the company is exploring better ways of working, including how to bring about better products, brands, and store experiences.

“Those things are always something that we are looking at on how we can improve. Even entries into new territories or new categories, for example, are something that we always study,” he said.

“In this ever-changing industry of fashion, we do not have a crystal ball, but then it is in our approach and how we do things. We always make it a point to find out what is important to our customer,” he added.

He said the process of figuring out what customers are looking for “is changing, and there is really no way to predict it, but again, we know, and we have the experience here, especially in the Philippines, to know what the tendencies of what our customers may be looking at are and what is important to them.”

“It is really being able to adapt even with TikTok … More than just using it as a social media platform, people are shopping on TikTok. So it is also being able to know how we can approach it, how we can do this live selling and approach it through something that still makes sense for the brand,” he added.

He said that accessibility in terms of price points and nationwide reach will continue to play a key part for Penshoppe.

“We are still very strong in terms of our physical stores … I’ll admit there are a lot of things we can still improve on, from how we translate in-store experience down to online, that integration,” he added.

PHL ready for Indian visitors — DoT

THE Department of Tourism (DoT) is expecting an increase in Indian travelers to the Philippines after the two countries established a strategic partnership.

“The two main hurdles for visiting the Philippines have been removed. First, the visa-free entry for nationals coming into the country,” Tourism Secretary Ma. Esperanza Christina G. Frasco said in a statement on Sunday.

“Second, direct flights have cut travel time from anywhere from 13 to 20 hours to only six hours, soon,” she added.

She also cited President Ferdinand R. Marcos, Jr.’s executive order offering digital nomad visas to attract long-staying professionals.

Last year, India was the Philippines’ 13th largest source market, accounting for 79,366 arrivals, mostly leisure travelers interested in beaches, shopping, and educational tourism.

“Secretary Frasco expressed optimism about increasing these numbers, emphasizing plans to intensify marketing campaigns aimed at attracting high-value and luxury travelers from India,” the DoT said.

In particular, she put forward Cebu as a wedding destination for Indian couples.

Another lucrative market being eyed by the department is the MICE (Meetings, Incentives, Conferences, and Exhibitions) segment, which in India is valued at $49 billion.

To support these initiatives, Ms. Frasco said that the department will offer familiarization trips and business-to-business meetings.

“We fully recognize the necessity of educating the market here, and that is why we are at present recalibrating our budgets to make sure that we fully invest in the Indian market,” she said. — Justine Irish D. Tabile