ACEN shares down following earnings data

ACEN Corp. shares fell last week as annual earnings decline led to heightened selling pressure.

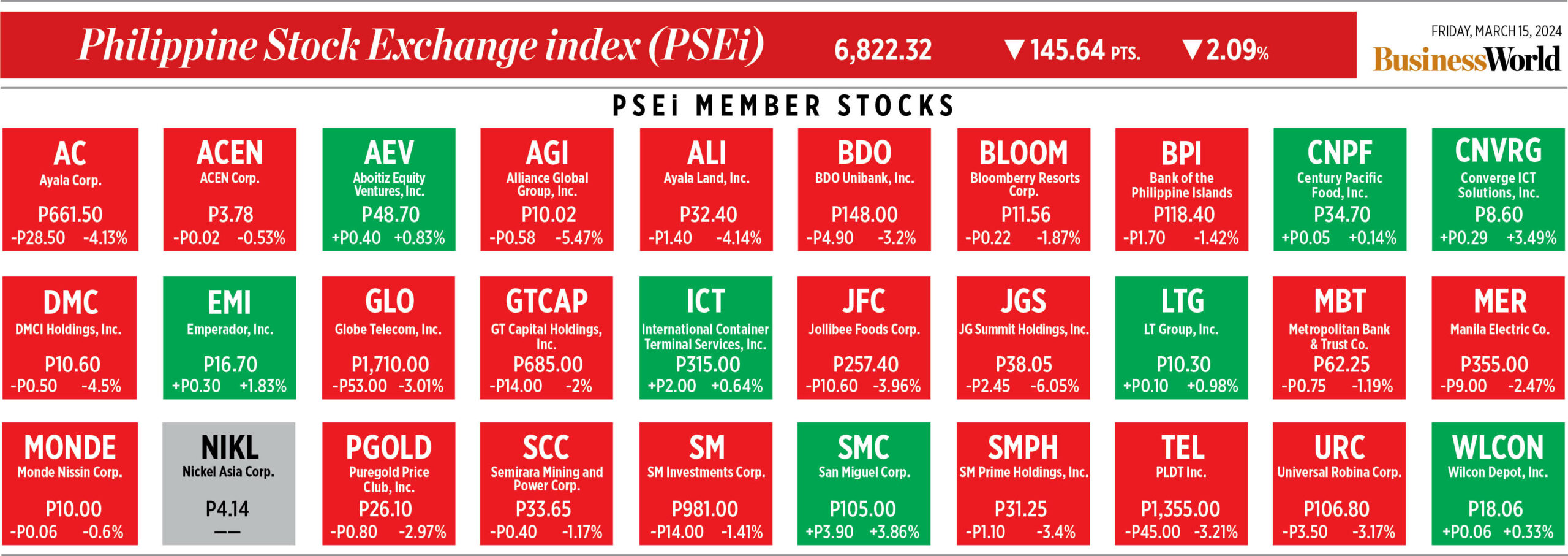

Data from the Philippine Stock Exchange (PSE) showed that Ayala-led ACEN had 105.89 million stocks worth P412.49 million exchanged from March 11 to 15.

ACEN’s price per share closed at P3.78 on Friday, lower by 7.4% from the P4.08 closing price the week before. Year to date, the stock declined 6.8% from the P4.38 finish on the last trading day of 2023.

Analysts attributed the stock movement to the dismal full-year earnings report of ACEN.

“[The] main reason for the continued selling pressure is their earnings announcement,” Mercantile Securities Corp. Head Trader Jeff Radley C. See said.

ACEN’s net income dropped by 37.6% to P9.11 billion last year from P14.6 billion in 2022.

The company’s net income attributable to its parent also fell to P7.4 billion, lower by 43.3% from P13.06 billion in 2022.

“[The decline] was primarily due to the remeasurement gain from acquiring the Australia platform in 2022,” Globalinks Securities and Stocks, Inc. Senior Trader Crismon V. Santarina said.

He added that the loss has now been reflected in the market as the company saw continued selling pressure.

“The stock is trading at oversold levels and there might be a possibility for it to touch the P3.50 level,” Mr. See said in an e-mail.

ACEN finished as the 9th most traded stock by volume last Friday.

On Tuesday, the renewable energy company announced a joint development project with US-based company BrightNight.

The project will facilitate the development of one gigawatt of renewables worth $1.2 billion over the next five years.

“[The project] is indeed positive news for ACEN. However, projects of this nature typically require time to develop, and their impact on the stock price is usually minimal,” Mr. Santarina said in a Viber message.

He added that investors remain wary of the growth stock as they opt for attractive blue-chip alternatives such as Meralco and Aboitiz Power.

This week’s closing price at P3.78 was the lowest since the P3.71 finish on Dec. 21 last year.

Both analysts see that ACEN’s share price may continue to decline for the coming week.

Given this, Mr. Santarina said that “[the stock] is a prime opportunity for investors to buy while it is near its 52-week low.”

He projects ACEN’s full-year net income at P11.3 billion.

“ACEN’s major support and major resistance are at P3.59 and P4.33, respectively,” Mr. Santarina said.

For Mr. See, support levels to look at are P3.50, P3, and P2.70. — Andrea C. Abestano