PHL gov’t may take time to adopt AI

By Keisha B. Ta-asan, Reporter

THE government may not be able to immediately adopt artificial intelligence (AI) technologies, with digital infrastructure in the country still underdeveloped.

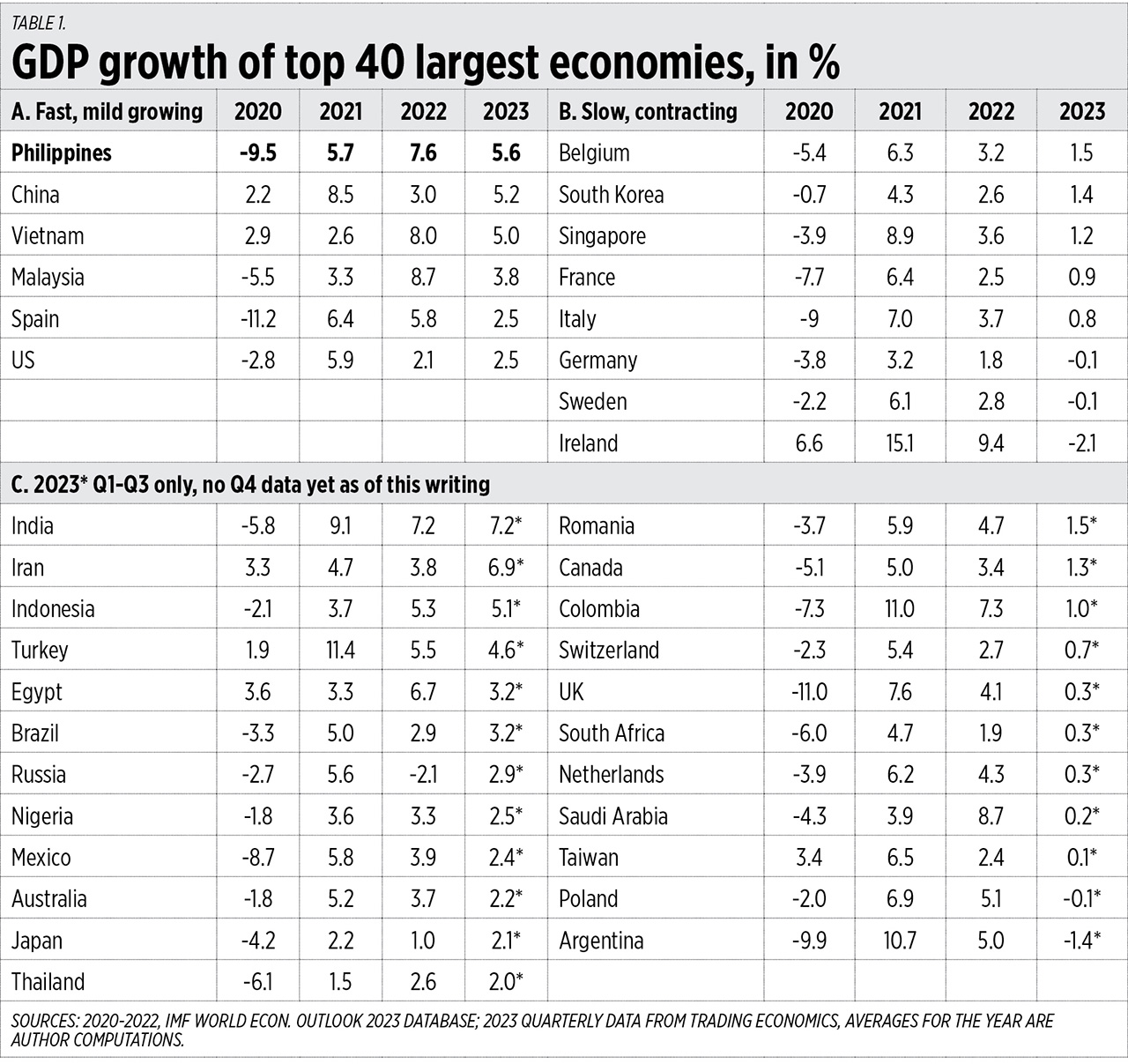

Laveena Iyer, an analyst from the Economist Intelligence Unit, said in an e-mail interview that economic development is more important for the government than adopting AI, as the Philippines is an emerging middle-income economy that could see growth slow this year, with elevated borrowing costs seen to continue weighing on consumption and investments.

“Now against this backdrop, one can understand why economic growth would be a bigger priority for the government compared with AI,” she said.

“Progress on digital infrastructure has been slow and this might be the case for AI as well. The country will take time to adopt this technology. In the meantime, it would have the opportunity to learn from the progress made in neighboring emerging economies,” she added.

Last week, the International Monetary Fund (IMF) said shifting to AI technologies could raise the level of labor productivity in the Philippine service sector.

However, this would require upskilling the labor force and developing the country’s digital infrastructure.

The IMF also said AI could affect nearly 40% of global employment. While it is seen to complement human work, it might replace other jobs and would likely worsen economic inequality among nations.

In emerging markets and low-income countries, AI exposure is expected at 4% and 26%, respectively, while about 60% of jobs in advanced economies are exposed to AI, it said.

According to Ms. Iyer, experiments with AI are still only beginning globally, and enterprises may still look for the right business fit for AI this year.

“Even some of the advanced economies and technologically mature countries are still figuring out how to do this. So, it is too early to say what use case would be right for the Philippines — perhaps, some form of automation,” she said.

AI may be useful for the logistics or healthcare industries, but its impact on employment in the Philippines is not concerning in the near term, she said.

Based on a Government AI Readiness Index by Oxford Insights, the Philippines fell 11 places to 65th out of 193 countries in 2023. The country scored 51.98 out of 100, higher than the 44.94 global average of markets that are ready to adopt AI.

“Given that the Philippines will have some time to watch what other countries have developed with AI and how their governments have sought to regulate it, there is scope to apply those lessons,” Ms. Iyer said.

She said the country will need to identify how to have a digitally skilled workforce and secure investments for stronger digital infrastructure for progress in AI, as well as in other industries and technologies.

“There will also be time for the Philippines to review and identify an optimum approach to regulate AI, wherein society is safeguarded against some risks but also innovation is allowed to flourish,” she said.

“Consideration must also be given to foster collaboration between the government and the industry.”

As for the private sector, Angelito “Lito” M. Villanueva, founding chairman of FinTech Alliance.Ph and executive vice-president and chief innovation inclusion officer at Rizal Commercial Banking Corp. (RCBC), said most industries are expected to explore AI technologies this year.

He said RCBC is starting to embrace AI, as officers were required to complete AI certification programs to help them understand machine learning and other AI concepts.

“In fact, we will be launching some digital products and programs that are AI-anchored by the first half of the year,” he told reporters during the annual reception for the banking community last week.

Several players in the financial technology industry that are interested in teaming up to explore emerging technologies such as AI, Mr. Villanueva added.

However, there are risks that come with any new technologies or platforms, he noted.

“We have to understand the whole proposition, and understand how to mitigate or control those risks,” Mr. Villanueva said, adding that firms should always guarantee better customer experience and consumer protection.

![manila-waters-[www.manilawater.com]](https://www.bworldonline.com/wp-content/uploads/2024/01/manila-waters-www.manilawater.com_-640x359.jpg)