YIELDS on government securities (GS) traded in the secondary market fell last week following the softer-than-expected March Philippine headline inflation print and the decline in US Treasuries after the Trump administration’s latest tariff announcement.

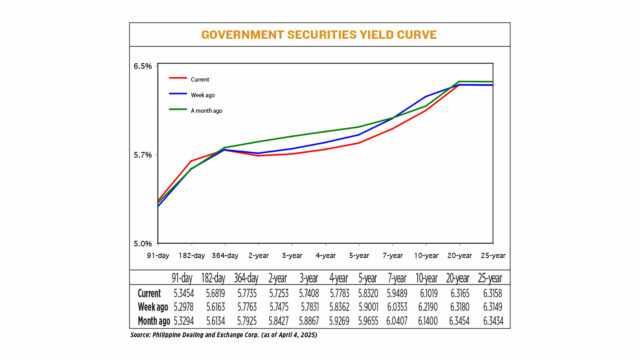

GS yields, which move opposite to prices, went down by an average of 2.58 basis points (bps) week on week, according to the PHP Bloomberg Valuation Service (BVAL) Reference Rates as of April 4 published on the Philippine Dealing System’s website.

Rates at the short end of the curve were mixed, with the 91- and 182-day Treasury bills (T-bill) going up by 4.76 bps (to 5.3454%) and 6.56 bps (5.6819%), respectively. Meanwhile, the 364-day T-bill went down by 0.28 bp to fetch 5.7735%.

At the belly, yields fell across all tenors. The rates of two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) declined by 2.22 bps (to 5.7253%), 4.23 bps (5.7408%), 5.79 bps (5.7783%), 6.81 (5.8320%) and 8.64 bps (5.9489%), respectively.

At the long end of the curve, yields on the 10- and 20-year T-bonds went down by 11.71 bps and 0.15 bp to 6.1019% and 6.3165 respectively. Meanwhile, the 25-year bond inched up by 0.09 bp to fetch 6.3158%.

GS volume traded amounted to P96.37 billion on Friday, higher than the P40.72 billion recorded a week earlier.

Yields mostly tracked the movement of US Treasuries as the market following the Trump administration’s reciprocal tariff announcement on Wednesday, analysts said, with slower Philippine headline inflation in March also causing GS yields to end lower week on week.

“Government bond yields traded lower by 5-12 bps week on week on the back of lower US rates and the softer-than-expected consumer price index (CPI) for March… The benign inflation print provided clarity for the Bangko Sentral ng Pilipinas’ (BSP) policy meeting, where the central bank is now expected to reduce benchmark rates by at least 25 bps,” Dino Angelo C. Aquino, vice-president and head of fixed income at Security Bank Corp., said in an e-mail.

“The Philippines is not a manufacturing country and is a net importer of goods; hence, these reciprocal tariffs won’t have much of an effect on the overall macroeconomic backdrop. Given the stable currency, benign inflation and the BSP resuming its easing cycle, local bond yields remain biased to move lower,” Mr. Aquino said.

A bond trader said the market is still assessing the tariff situation, with most players taking a wait-and-see stance.

“But overall, this is more of a growth concern for the Philippines than inflation,” the bond trader said.

Financial markets were gripped by recession fears as stocks extended a punishing global sell-off on Friday in the wake of US President Donald J. Trump’s sweeping tariffs, helping drive a rally in US Treasuries and supporting gold near a record peak, Reuters reported.

The frenetic activity in markets came after Mr. Trump on Wednesday announced Washington’s steepest trade barriers in more than 100 years, sparking a scramble among investors for safe havens like government bonds, the yen and gold.

US Treasury yields slid as investors poured into the safe-haven bonds. Bond yields move inversely to prices.

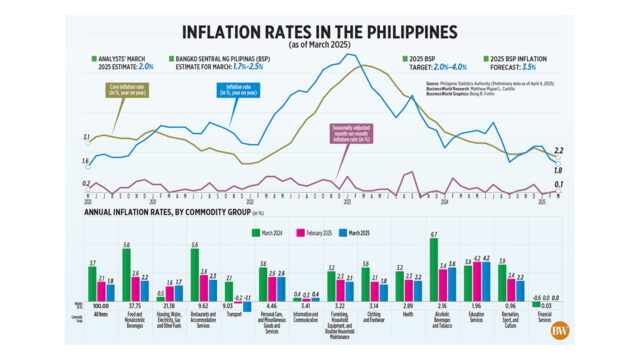

Meanwhile, Philippine headline inflation eased to a near five-year low in March, the government reported on Friday. The consumer price index stood at 1.8% in March, easing from the 2.1% in February and 3.7% a year ago.

This was within the BSP’s 1.7%-2.5% forecast for the month and below the 2% median estimate in a BusinessWorld poll of 18 analysts.

The March print was the lowest in 58 months or since the 1.6% logged in May 2020 at the height of the coronavirus pandemic.

For the first quarter, inflation averaged 2.2%, well within the central bank’s 2-4% target.

Analysts said the slower March inflation print sets the stage for the BSP to resume its easing cycle when it meets to review policy on Thursday.

All 17 analysts in a BusinessWorld poll conducted last week expect the Monetary Board to reduce the target reverse repurchase rate by 25 bps to 5.5% at its April 10 meeting.

This would mark its first easing move since December as the BSP unexpectedly kept benchmark interest rates steady in February in a “prudent” move to assess the potential impact of the Trump administration’s evolving trade policies on the Philippine economy.

The Monetary Board has brought down borrowing costs by a cumulative 75 bps since it began its rate-cut cycle in August last year.

BSP Governor Eli M. Remolona, Jr. last month said there is a “good chance” that the central bank will cut rates by 25 bps at its April 10 meeting, especially if March inflation is better than expected.

Mr. Remolona also signaled potential cuts of 50 to 75 bps for the year.

For this week, the trader said GS yield movements will likely depend on the BSP’s policy decision and the Bureau of the Treasury’s bond auction on Tuesday.

“US payroll numbers may play a factor in this week’s trading, but tariff uncertainties remain the focal point for global markets and global yields. As the trade war intensifies, we may see US rates continue to move lower and local bonds to trade lower in sympathy as well,” Mr. Aquino added. — Lourdes O. Pilar with Reuters