By Calixto V. Chikiamco

WHY did the administration’s candidates perform poorly in the midterm elections?

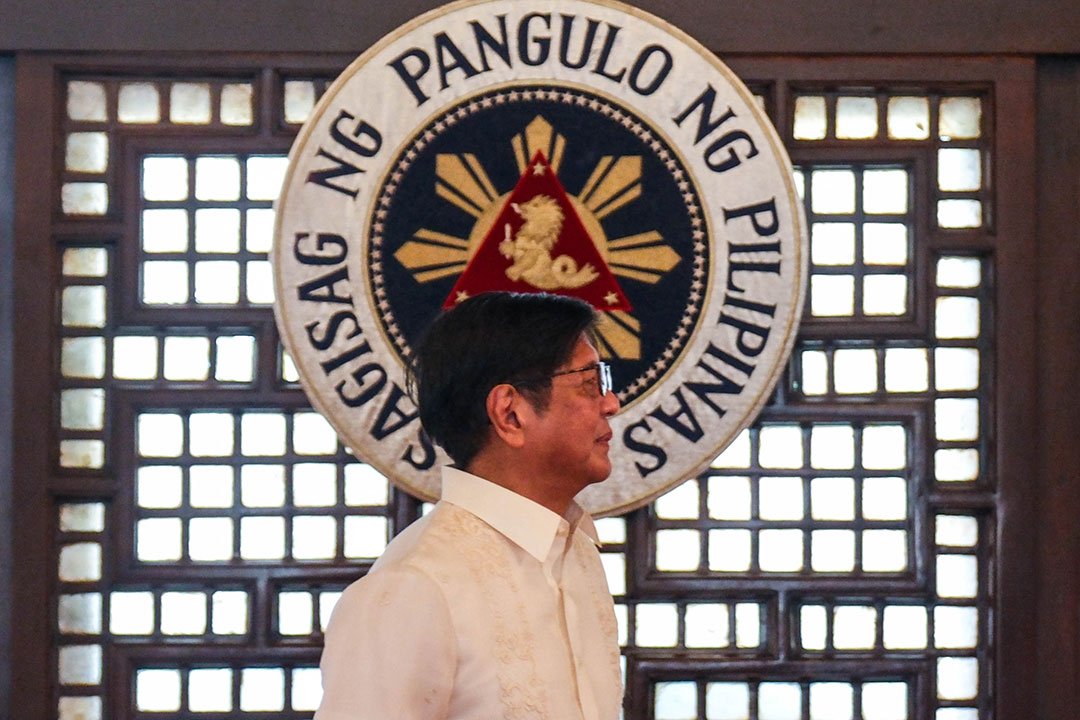

The conventional wisdom is that it was President Ferdinand “Bongbong” Marcos, Jr.’s handling of former President Rodrigo Duterte’s arrest and detention at the International Criminal Court (ICC) that turned off the voters and resulted in the anti-administration vote.

However, if this were true, why did Bam Aquino and Francis Pangilinan exceed all expectations and land in 2nd and 5th place in the senatorial elections? Bam Aquino and Francis Pangilinan belong to the Yellow or Pink opposition and are known to be Duterte’s political enemies. Former Senator Leila de Lima, whom Duterte jailed for alleged drug ties, got a seat in Congress under the Mamamayang Liberal Party. Akbayan, no political friend of Duterte, also got the highest number of votes for party-list representation.

Therefore, the midterm elections cannot be construed purely as a pro-Duterte vote. Rather, it was a political rebuke of the administration, with the anti-administration votes shared by both the Yellow and Pink opposition and the Duterte camp.

My theory is that the administration’s handling of the economy made voters sour on the administration candidates. As it was in the last US presidential election, it was “the economy, stupid!” It was the high cost of living that turned independents, young men, and even some Latinos and blacks against the Biden administration and the Democratic party, polling after the election revealed.

Similarly, the high cost of living here, primarily driven by high food prices, caused voter dissatisfaction, and likely caused an anti-administration vote. An SWS survey revealed that the economy, including job creation and cost of living, remained the top issue of many voters.

Voters probably saw through the P20 a kilo rice as too gimmicky and its effects too limited.

It wasn’t only the high food prices that weighed on the overall cost of living, the “higher for longer” interest rates probably did too. In response to the escalating food prices and higher than targeted inflation, the Bangko Sentral ng Pilipinas (BSP) raised interest rates. The negative effect of the higher interest rates resulted in slowing down the economy (5.2% in the fourth quarter 2024 and 5.4% in the first quarter 2025, instead of the targeted 6%). However, it was felt most notably in the real estate sector, as middle-class buyers dropped out of the market for residential condominiums because of the higher mortgage payments. This is the reason why a severe imbalance between supply of condominiums for the middle class and demand occurred, and condominium developers were left with lots of unsold inventory, especially in non-premium locations in Quezon City, Pasig, and Manila.

The problem of President Marcos Jr. is that he resorted to the old paradigms: protectionism, statism, and populism to manage the economy, and he got a political blowback as a result.

Consider former President Duterte in contrast. The first thing he did was to cut taxes for the middle class by adjusting the tax rates, which, because of inflation, pushed a lot of workers into higher tax brackets. He also cut taxes for corporations (from 30% to 25%), introduced more competition in the telco sector (Ditto), cut bureaucratic red tape (the ARTA law), simplified payment of inheritance taxes, simplified land titling (RA 11573), and removed the restrictions on agricultural patents (RA 11573), lifted the mining and open-pit mining ban, increased infrastructure spending, dismantled the National Food Authority (NFA) monopoly and liberalized rice importation, leading to lower rice prices.

In other words, former President Duterte adopted pro-market policies of more competition, deregulation, tax simplification, and liberalization that boosted the economy and improved general well-being. This was why he enjoyed high approval ratings even when he left office.

On the other hand, the first economic legislation that President Marcos Jr. pushed for was the Maharlika Investment Fund, whose effects can hardly be felt by the masses.

He also resorted to statism by getting the Department of Agriculture and the NFA back into the rice game. There was even an attempt to control rice prices by imposing rice price caps and blaming “hoarders and speculators.” Not surprisingly, those targeted rice traders just withheld supply from the market.

Instead of liberalizing food importation, the administration doubled down on protectionism by keeping the same import quotas on corn, sugar, fish, and other commodities. It didn’t help that there was no attempt to reform the phytosanitary clearance process, which was used to control importation.

Let us take the example of corn. Because the domestic price of corn is high and it accounts for 60% of the cost of poultry and swine production, our chicken and pork prices are double those of Thailand and Vietnam. We can’t produce enough corn domestically and at affordable prices because of our small-scale agriculture (land reform* was the culprit). However, corn importation is controlled through a system of quantitative restrictions. The annual import quota of 216,000 metric tons for corn is way below the industry requirement of 3 to 4 million metric tons. Out-quota importations are slapped with a 50% tariff. Instead of allowing the market to determine import volumes, the Department of Agriculture allocates the quota to favored traders.

The result is high corn prices, high chicken prices, high pork prices, and therefore, higher protein malnutrition, higher cost of living, and dissatisfaction with the status quo.

However, another economic policy will likely increase public dissatisfaction in the months ahead: allowing the peso to strengthen.

The strong peso is reducing the incomes of overseas Filipino workers’ (OFW) families, making it cheaper to import goods that will compete with local industries, discouraging exports, and reducing the profitability of business process outsourcing firms or BPOs, which are already facing challenges from Artificial Intelligence. The pain of OFW families will be particularly acute as they rely on these remittances to support their daily cost of living. Local manufacturers are also seeing a flood of Chinese imports. Even Philippine retailers are stressed by cheap goods from China being sold through Lazada, Shopee, Temu, and TikTok.

The strong peso is undermining the tariff advantage that the Philippines enjoyed under Trump’s Liberation Day tariffs, with the Philippines being slapped with a 17% tariff compared to Vietnam’s 47%, Indonesia’s 32%, and Thailand’s 36%.

The strong peso is also undermining a key economic strategy of the administration: forging FTAs or Free Trade Agreements with the EU, UAE, Canada, and the USA. The Department of Trade and Industry is also pushing for the country’s membership in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

Why would investors come here and take advantage of our relatively lower tariffs under Trump or duty-free access to foreign markets when the strong peso makes labor and other domestic resources more expensive and makes exporting from the Philippines less competitive?

The BSP can, and has, shrugged off the strong peso because its mandate is inflation rate targeting, not exchange rate targeting. That may be, but there will be real political and economic consequences for the administration. Growth will surely slow, and there will be a lot of unhappy people, from OFW families to local manufacturers, and from exporters to farmers.

With oil prices, as well as prices of other commodities, from fertilizer to rice, softening and China dumping its surplus goods in our market, it’s unlikely that a weak peso will substantially increase inflation. The timing may be right to allow the peso to weaken and let an undervalued peso protect us, including our farmers, from imports rather than quantitative restrictions.

President Marcos Jr. has just three years left to generate the political capital to ensure that there will be a friendly leader to succeed him. Resorting to the old paradigm of protectionism, statism, populism, and a strong peso will make that task harder. It’s time for him to take a risk and try a new paradigm.

*The Comprehensive Agrarian Reform Program or CARP

Calixto V. Chikiamco is a member of the board of IDEA (Institute for Development and Econometric Analysis).