Nov. trade deficit balloons to record

By Lourdes O. Pilar, Researcher

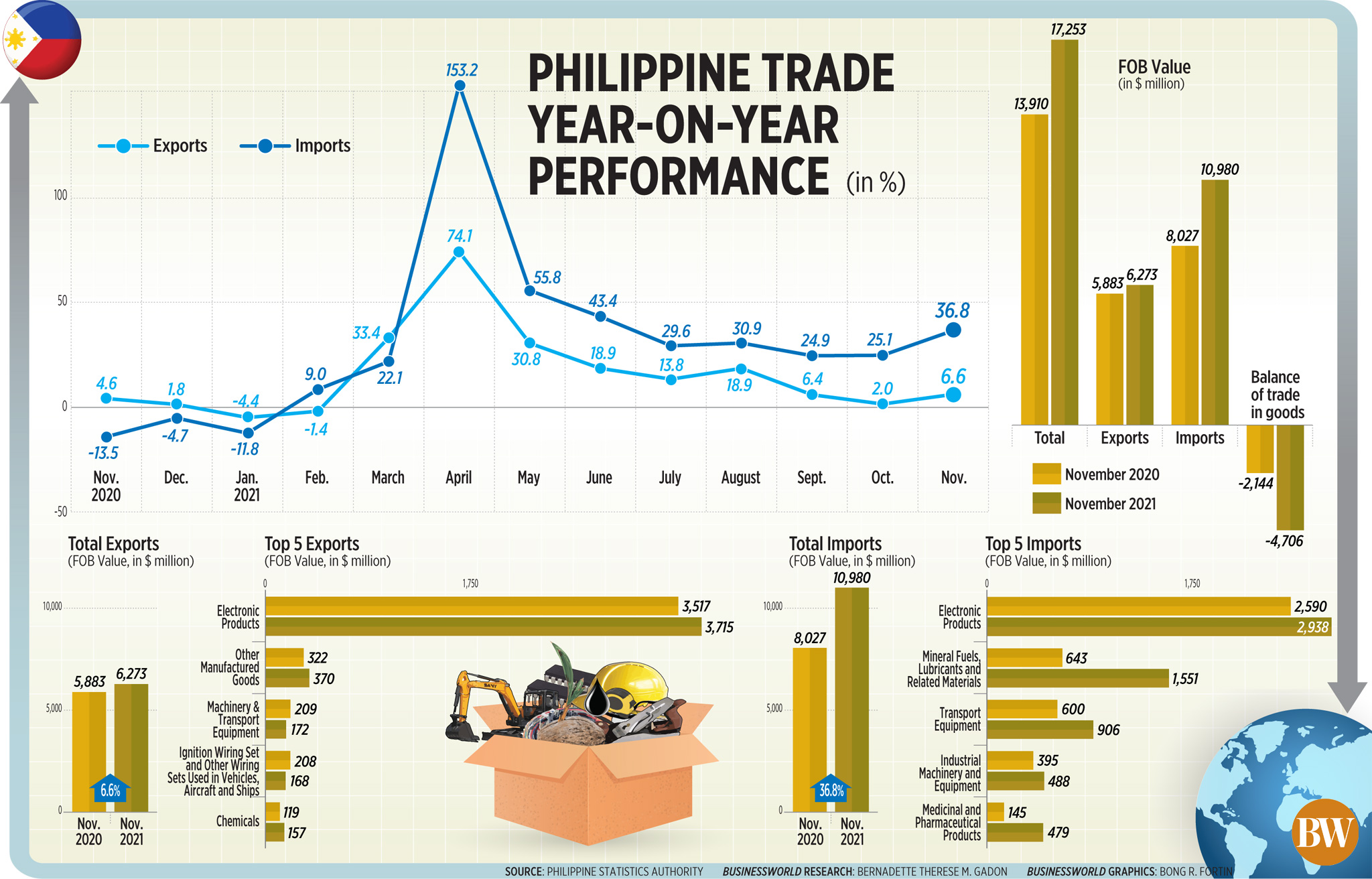

THE COUNTRY’S trade-in-goods deficit further widened to a record high in November as growth in merchandise imports continued to outpace the rise in exports, the Philippine Statistics Authority (PSA) reported on Tuesday.

Export receipts grew by 6.6% year on year to $6.27 billion in November, preliminary data from the PSA showed.

This was higher than the 4.6% increase in the same month in 2020 and the 2% growth in October 2021. November’s export growth was the highest in three months or since August’s 18.9% expansion.

The value of November exports slipped to a six-month low or since May’s $5.94 billion.

Meanwhile, the country’s merchandise import bill rose by 36.8% to a record $10.98 billion in November.

This marked a turnaround from the 13.5% fall in November 2020 but faster than the 25.1% increase in imports in October 2021.

This was the highest import growth in five months or since the 43.4% surge recorded in June.

This brought the trade-in-goods deficit to $4.71 billion in November, wider than the $2.14-billion shortfall recorded in the same month last year, as well as the $4.11-billion gap in October.

This was the widest monthly trade gap on PSA’s record dating back to 1991.

Year to date, the trade balance ballooned to a $37.92-billion deficit, from a $22.15-billion trade gap in 2020’s comparable 11 months.

For the 11-month period, exports jumped by 15.2% year on year to $68.37 billion. This was below the revised 16% growth projected by the Development Budget Coordination Committee for 2021.

Imports, on the other hand, climbed by 30.4% to $106.30 billion, slightly above the government’s revised 30% assumption.

Outbound shipment of manufactured goods grew by 5.9% to $5.30 billion in November. These goods accounted for 84.4% of total export sales that month.

Electronic products, which made up 70.2% of manufactured goods and more than half of the total exported goods, rose by 5.6% to $3.71 billion in November. Of these, semiconductors contributed $2.62 billion — up by 3.7% from November 2020.

Agro-based products increased by 36.1% to $491.22 million, while forest products went up by 6% to $34.25 million.

However, sales of mineral and petroleum products contracted by 8.9% to $359.27 million and 95.2% to $42,000, respectively.

All major import items posted significant annual growth in November.

Raw materials and intermediate goods, which accounted for 38.7% of import goods in November, grew by 39.2% to $4.25 billion.

Imports of capital and consumer goods were valued at $3.35 billion (up 18.8%) and $1.76 billion (up 22.7%) in November.

Purchases of mineral fuels, lubricant and related materials more than doubled to $1.55 billion in November from $642.87 million in the same month in 2020. These goods accounted for 14.1% of the country’s total imports that month versus just 8% in the same month in 2020.

Asian Institute of Management (AIM) economist John Paolo R. Rivera said that improved trade performance was “expected” as the pandemic situation in the country improved from September until December.

“Because of increased demand locally due to a more active economy, imports were expected to gain steam. Exports, on the other hand, were also expected to perform given the varying pace of economic recovery by our trading partners,” he said in an e-mail interview.

“The last quarter of 2021 was a good window for the economy to get moving until the Omicron variant threatens this recovery process momentum,” Mr. Rivera said.

In a note to reporters, ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said higher fuel imports was one of the factors for the widening trade gap.

“Costlier imported crude oil translated to overall fuel imports rising sharply, which in turn helped bloat the trade deficit to its current record high,” he said. “With global crude oil prices staying elevated to open the year, the Philippines could continue to experience wider trade deficits in the near term.”

OUTLOOK

The government’s trade targets for 2021 were on track to be met, but the fresh surge in new coronavirus cases may hurt this year’s trade growth assumptions.

The interagency DBCC expects exports and imports to grow by 6% and 10%, respectively, this year.

“The problem would be felt in the first quarter of 2022 due to Omicron. But for 2021, I think the government will meet its targets for exports and imports,” Philippine Exporters Confederation, Inc. President Sergio R. Ortiz-Luis, Jr. said in a phone interview.

AIM’s Mr. Rivera expects the 2021 targets to be met with “slim margin or slim shortfall.”

“Given the economic conditions during the last quarter of 2021 and the performance in the previous quarters, the Delta variant surge was the most significant threat to meeting economic target performances,” he said. “The threats were significant in altering the growth trajectories of trade figures even in the first quarter of 2022.”

For ING’s Mr. Mapa, the ballooning trade gap pushed the country’s current account balance to a deficit in 2021. He expects this trend to continue this year.

The current account shows a country’s transactions with the rest of the world. It includes trade in goods and services, remittances from migrant Filipino workers, profit from Philippine investments overseas, interest payments to foreign creditors, and gifts, grants, and donations to and from abroad.

“With the current account expected to remain in deficit territory, pressure on PHP (Philippine peso) to weaken should persist in 2022 although other factors such as the looming Fed rate hike will likely play a major role in the currency’s trajectory this year,” Mr. Mapa said.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a note sent to reporters that the recent surge in new coronavirus cases will be a drag on economic recovery prospects and on trade.

“Lingering concerns over the Omicron variant could also add to the disruptions in the global supply chains amid isolation and quarantine for increased number of infected workers for many businesses and industries worldwide,” he added.

Mr. Ricafort said the trade deficit could be sustained at the $4-billion levels per month this year for as long as the global oil prices remained elevated as the pandemic-induced supply chain disruptions continue.

“For the coming months, further pickup in imports and exports could also be supported by still near-record-low short-term interest rates that could help spur greater demand for loans for new investments that entail the more importation and also more export production as well as more jobs and other business opportunities in the supply chain and for related businesses and industries,” Mr. Ricafort said.