Yields on gov’t debt rise

YIELDS on government securities (GS) rose last week following faster September inflation, which increases the possibility of an off-cycle hike from the Bangko Sentral ng Pilipinas (BSP).

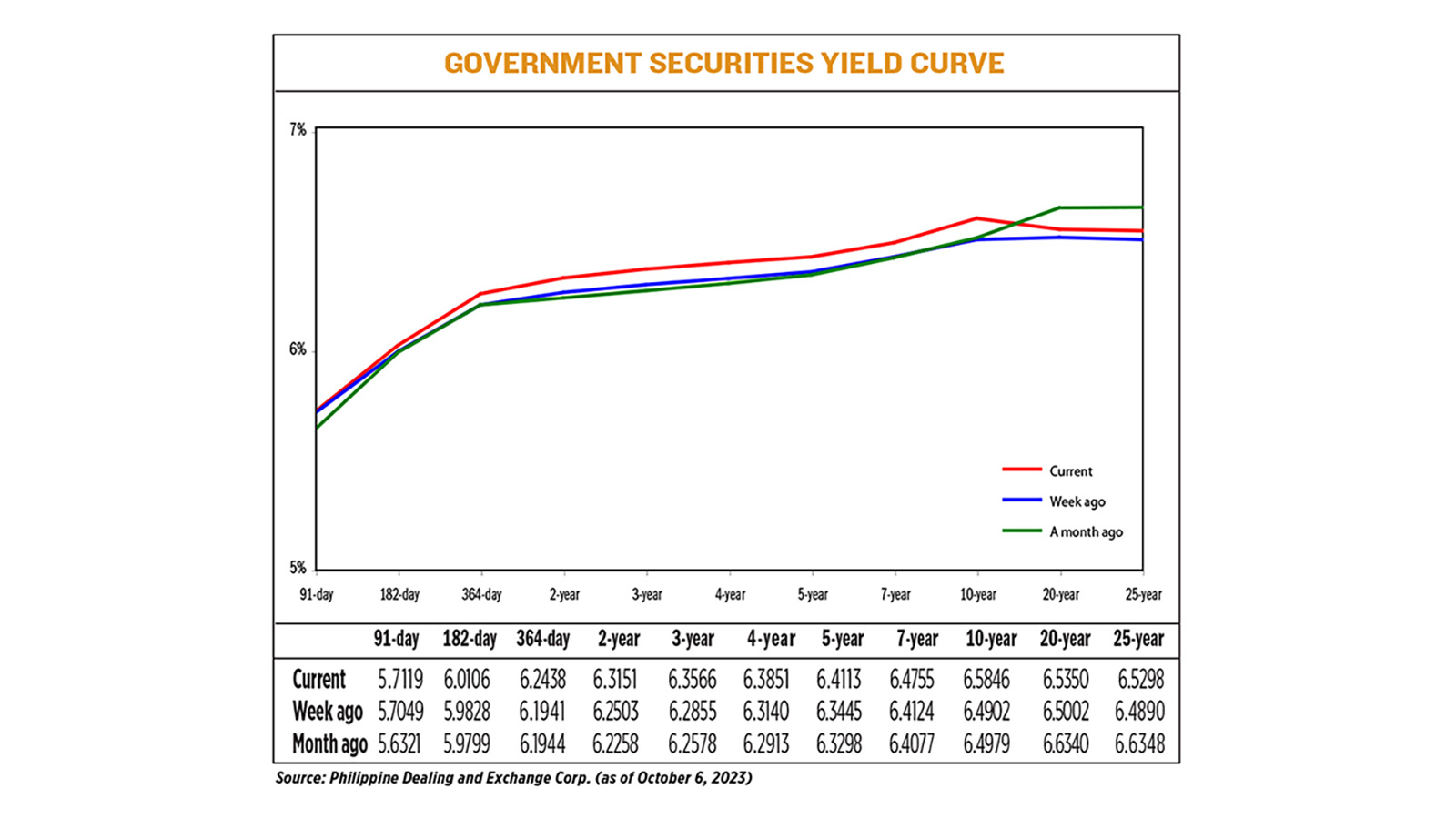

GS yields, which move opposite to prices, went up by an average of 5.38 basis points (bps) week on week, according to PHP Bloomberg Valuation Service Reference Rates data as of Oct. 6 published on the Philippine Dealing System’s website.

Yields rose across the board, with the 91-, 182-, and 364-day Treasury bills going up by 0.7 bp to 5.7119%, 2.78 bps to 6.0106%, and 4.97 bps to fetch 6.2438%.

At the belly, rates of the two-, three-, four-, five-, and seven-year Treasury bonds (T-bonds) went up by 6.48 bps (6.3151%), 7.11 bps (6.3566%), 7.11 bps (6.3851%), 6.68 bps (6.4113%), and 6.31 bps (6.4755%).

At the long end, the 10-year paper rose by 9.44 bps to fetch 6.5846%, while yields on the 20- and 25-year papers increased by 3.48 bps and 4.08 bps to 6.535% and 6.5298%, respectively.

Total GS volume reached P10.59 billion on Friday, down from P10.96 billion on Sept. 29.

Yields ended higher due to faster-than-expected September inflation and as the market took a defensive stance ahead of US data releases, analysts said.

“Players unwound positions in the 9- to 10-year area, where it was paid on at levels 4-5.5 bps [week on week]. Bargain-hunters paid on due to a lack of supply for the past two weeks due to the RDB (retail dollar bond) offering,” Union Bank of the Philippines, Inc. peso fixed-income trader Chester Duane E. Ani said via e-mail.

Headline inflation picked up a three-month high of 6.1% in September from 5.3% in August, data released by the Philippine Statistics Authority last week showed.

This was slower than the 6.9% print in September 2022, but matched the high end of the BSP’s 5.3-6.1% forecast for the month.

The September consumer price index (CPI) was also above the 5.4% median estimate in a BusinessWorld poll of 17 analysts and marked the 18th consecutive month that inflation exceeded the 2-4% target for the year.

For the first nine months, the CPI averaged 6.6%, above the central bank’s 5.8% forecast for the year.

Following the data release, the BSP said it “stands ready to resume monetary policy tightening as necessary to prevent the renewed broadening of price pressures.”

For this week, hawkish signals from the central bank and its reassurance to resume monetary tightening if needed could send yields higher, Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort said in an e-mail.

“[The] next local policy rate-setting meeting could match the next Federal Reserve rate decision in order to maintain healthy interest rate differentials to support stability of the peso exchange rate, import prices, and overall inflation,” Mr. Ricafort said.

“Players will definitely remain defensive amid hawkish concerns and trade from a wait-and-see mode. Most of the price action will be driven by the upcoming auctions,” Mr. Ani likewise said. “Locally, markets will really be interested with the [10-year] auction.”

On Tuesday, the Treasury bureau will offer P30 billion in reissued 10-year T-bonds with a remaining life of five years and three months. — BTMG