Coal, gas, renewables, and growth

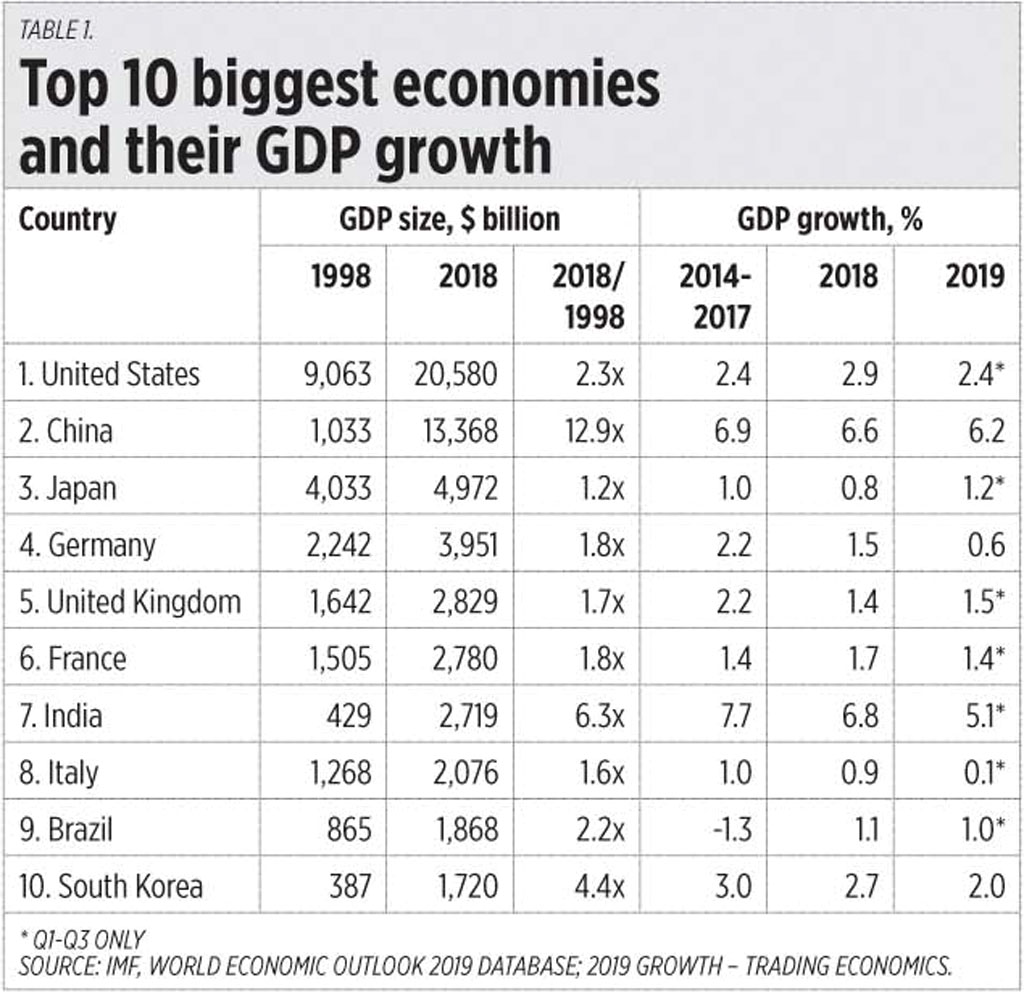

Recently it was reported that the growth rate of Germany, Europe’s largest economy and the world’s fourth largest, fell to only 0.6% in 2019. This caught my attention because it is a significant drop from 1.5% in 2018 and 2.2% average for 2014-2017. The UK and France managed to grow 1.4% in Q1-Q3 2019 so far, while Italy has crawled to only 0.1% growth (see Table 1).

From 1998 to 2018, or two decades, China, India, and South Korea have managed to expand their GDP size from four to 13 times while others have expanded only by 2.3 times at most. So we may ask, what are the “secrets” of China, India, and South Korea for the big expansion of their GDP sizes?

There are a dozen plus factors, but for this paper, I want to test the hypothesis that “stable, cheaper energy is stable growth.” Thus, I will leave out other factors (rule of law, property rights protection, global openness, lower taxes, etc.) for now.

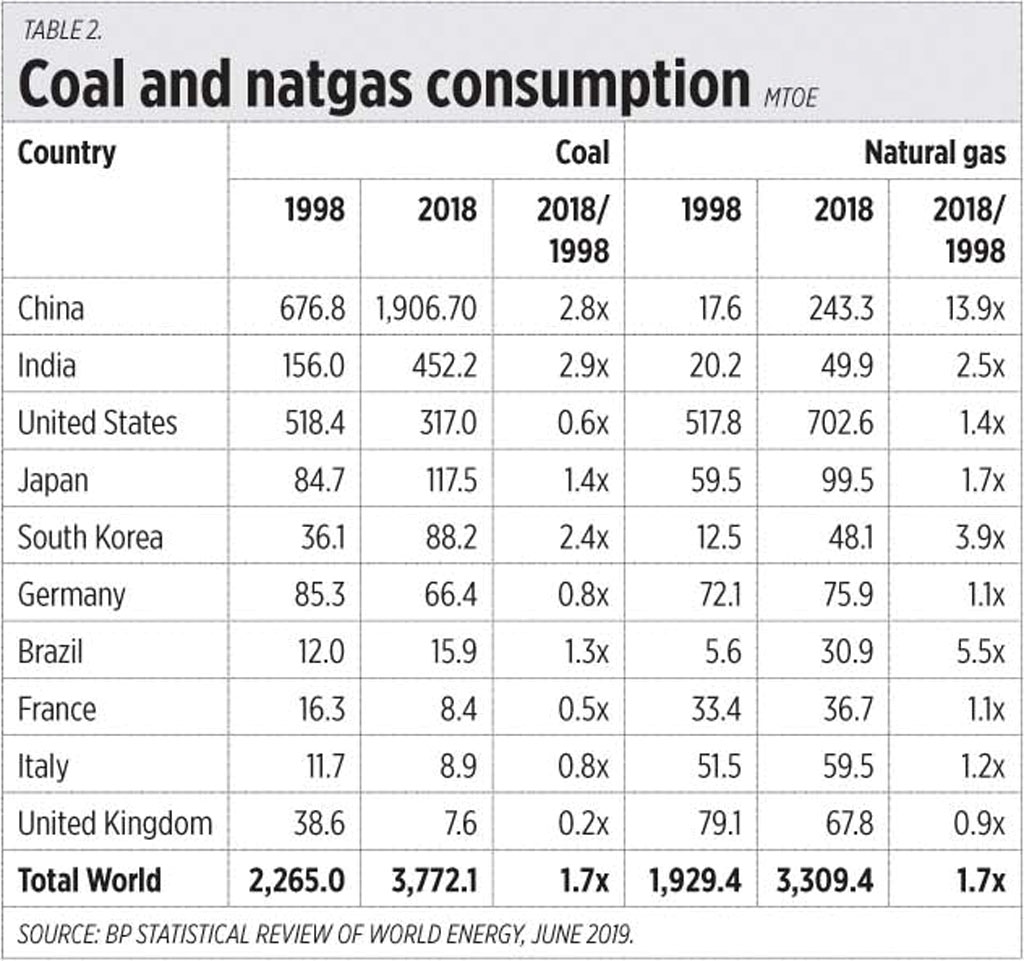

First I checked the consumption of fossil fuels coal and natural gas — stable, predictable, dispatchable on demand — in power generation, units in million tonnes oil equivalent (mtoe).

China, India, and South Korea have indeed expanded their coal capacity by 2.4 times to 2.9 times while the four Europeans and the US have decreased their coal consumption. But the US has increased its already high consumption of natural gas while China and South Korea have also expanded their gas use but not at the level of the US (see Table 2).

Then I checked their consumption of intermittent, unstable, and non-dispatchable energy sources like wind and solar. China, the US, and Germany are the world leaders, with India, Japan, and the UK trying to catch up (see Table 3).

The total consumption of wind and solar, despite their rapid expansion in recent years, remain very small compared to use of coal and gas for many countries. For instance, the wind and solar of China (123 mtoe), India (20.6 mtoe), and South Korea (2.6 mtoe) in 2018 were only 6.4%, 2.8%, and 2.9% respectively of their coal consumption. The US’ wind and solar (84.8 mtoe) in 2018 was only 12.1% of its natgas consumption.

It is safe to say that the reason why China, India, and South Korea have expanded their economies faster than the other seven large economies is partly (or largely) because they relied more on stable and cheaper fossil fuels especially coal, and never relied on intermittent, unstable wind and solar in their continuing march towards modernization and industrialization.

The US has escaped the anemic growth pattern of the Europeans because it increased its reliance on natgas, also a fossil fuel, even though its coal use has declined.

US President Donald Trump is correct in his opening speech at the ongoing 50th World Economic Forum (WEF) in Davos, Switzerland, that US will pursue its energy independence (and dominance) in fossil fuels and not be swayed by climate scare and doom stories, and embrace the energy of low and anemic growth — wind and solar and other variable renewables.

Bienvenido S. Oplas, Jr. is the president of Minimal Government Thinkers.