FINANCIAL MARKETS may continue to experience volatility in the near term following the Federal Reserve’s start of its tightening cycle and the geopolitical tensions between Russia and Ukraine.

The barometer Philippine Stock Exchange index (PSEi) averaged 7,206.92 in the October-December period, up by 6.8% from 6,750.01 on a quarter-on-quarter basis. On an end-period basis, the index was up by 2.4% to 7,122.09 from 6,952.88 the previous quarter.

Meanwhile, the peso averaged P50.45 against the dollar in the fourth quarter, depreciating by 0.6% from the previous quarter’s average of P50.14:$1, and 4.5% weaker compared with the P48.27-to-a-dollar average seen in the fourth quarter of 2020, data by the Bangko Sentral ng Pilipinas (BSP) showed.

Treasury bill (T-bill) auctions conducted in the last three months of 2021 continued to see robust demand, data by the Bureau of the Treasury showed. Total subscriptions in these T-bills reaching around P461.6 trillion, which is estimated 3.1 times the P150-billion aggregate offered amount. This oversubscription amount of P311.6 billion was lower compared with the P506.7 billion posted in the previous quarter.

Similarly, auctions of Treasury bonds (T-bonds) during the period posted a total subscription amount of P360 billion, 12 times more than the offered amount of P30 billion.

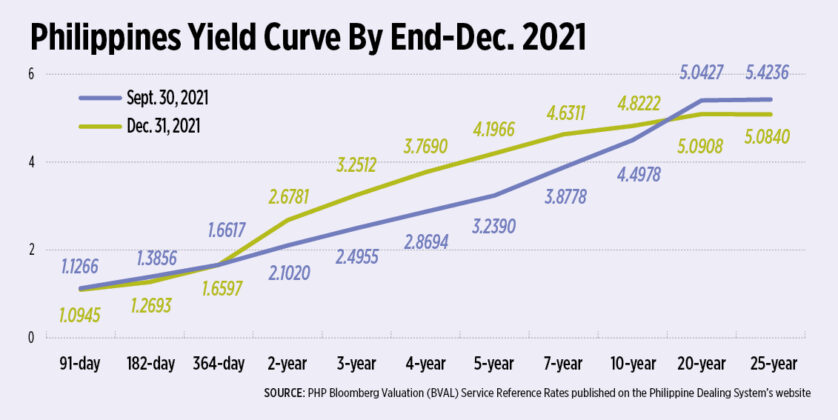

At the secondary bond market, domestic yields were higher by 32.4 basis points (bps) for the 10-year T-bonds and 95.8 bps for the five-year papers compared with end-September 2021 levels.

However, the yields for 91-day, 182-day, 365-day, 20-year and 25-year government securities were lower by 3.2 bps, 11.6 bps, 0.7 bp, 31.2 bps and 34 bps, respectively, according to the PHP Bloomberg Valuation Service Reference Rates published on the Philippine Dealing System’s website.

“Markets were generally supported by the improvement in the local coronavirus disease 2019 (COVID-19) situation, the ease in COVID-related movement restrictions, and the continued accommodative policy stance of the BSP,” the central bank said in an e-mail.

The BSP added that local markets were also supported by upbeat economic data releases during the period.

The Philippine economy rose by 7.7% in the final three months last year, higher than the 6.9% in previous quarter and a turnaround of the 8.3% contraction in the fourth quarter of 2020. This brought the full-year GDP growth to 5.6%, a reversal from the record 9.6% decline posted in 2020. This surpassed the revised 5-5.5% 2021 growth assumption of the Development Budget Coordination Committee (DBCC) last year.

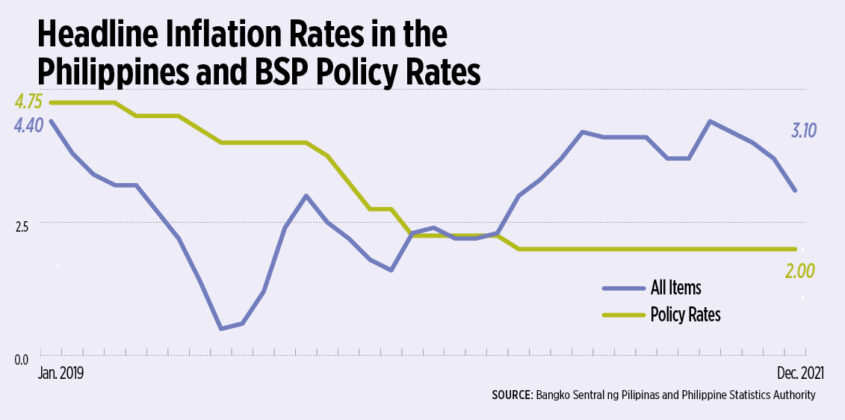

Under Philippine Statistics Authority (PSA) rebased 2018 prices, inflation continued to show downward result for the fifth straight month in December at 3.2%. The inflation averaged 3.9%, still within the central bank’s target range of 2-4% last year.

However, BSP expressed that towards the end of the year, sentiment was dampened by concerns over the economic impact of Typhoon Odette, worries over the Omicron variant and expectations that the US Federal Reserve (US Fed) will stay on its path of interest rate hikes in 2022.

“Factors which affected the financial markets in the fourth quarter of 2021 are likely to remain relevant in the early parts of 2022, including the pace of economic recovery and progress in the easing of coronavirus-related restrictions. These may continue to provide support to the local markets. However, the looming interest rate hikes by the Fed may limit gains,” added BSP.

After keeping an accommodative policy environment for nearly four years, the US Federal Reserve hiked its near-zero policy rates by 25 bps to fight 40-year-high inflation. The central bank of the world’s largest economy expects its interest rate to range between 1.75-2% by end of this year, translating to six 25-bp increases for the remaining Fed meetings.

The BSP said it will not follow the pace of the adjustments made by the Fed. BSP Governor Benjamin E. Diokno said the central bank would remain patient and expects to adjust interest rates by the latter half of the year to ensure sustained economic recovery.

However, Bank of the Philippine Islands (BPI) Lead Economist Emilio S. Neri, Jr. said the central bank might need to adjust its monetary policy to temper the impact of the Fed tightening especially on the exchange rate.

“Expectations of tighter dollar liquidity in the coming months might exert pressure on the peso and the BSP’s dollar reserves if the policy rate is kept at 2%,” Mr. Neri said in an e-mail.

The BSP maintained the key policy interest rate on the overnight reverse repurchase facility at record low 2%. The corresponding interest rates on the overnight deposit and lending facilities remained at 1.5% and 2.5%, respectively.

The central bank’s Monetary Board will meet to review its current policy settings on March 24.

WHAT INDICATORS TO WATCH OUT FOR

Aside from policy normalization and potential threats from new COVID-19 variants, economists said investors should watch out for market volatility amid the ongoing conflict between Russia and Ukraine.

In late February, Russia invaded Ukraine on the pretext of demilitarization and “denazification.” This sent commodity prices, most notably oil, surging to levels not seen since 2014.

“The ongoing conflict will likely continue to roil financial markets with general flight to quality. The peso could come under considerable heat given a likely bloating of the import bill due to expensive oil,” ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail.

“The situation remains fluid particularly with the sanctions imposed and to be imposed as well as the uncertainty if this conflict will remain protracted or reach a faster resolution,” Security Bank Corp. Chief Economist and Assistant Vice-President Robert Dan J. Roces said in an e-mail.

“As such that uncertainty will continue to roil markets and cause volatility,” he added.

For Rizal Commercial Banking Corp. (RCBC) Chief Economist Michael L. Ricafort, he said the financial markets could remain volatile in the first quarter amid increased geopolitical risks related to Russia’s invasion/war with Ukraine, in view of the uncertainties ahead.

The central bank also flagged the risks of the rising global oil prices amid the ongoing tensions between the two East European countries.

“Movement in oil prices should also be monitored as this would have a significant effect on global inflation and may prompt other central banks to begin tightening their monetary policies as well,” the BSP said.

It also warned of the market jitters on the uncertainty of the local political landscape due to the upcoming May 2022 national elections as this could weigh on investors’ risk sentiment.

INFLATION OUTLOOK

BSP estimated that the inflation would ease towards the midpoint target range of 2-4% target range this year.

BPI’s Mr. Neri said domestic inflation has slowed down in recent months but sees risks that could change its direction.

“Strong demand and limited increase in oil supply may continue to push oil prices higher. Peso depreciation is another factor that could drive the increase in consumer prices,” Mr. Neri said in an e-mail.

Union Bank of the Philippines Chief Economist Ruben Carlo O. Asuncion expects Typhoon Odette’s (international name: Rai) supply shocks to ease in March but agricultural output could be aggravated by the dry season in the second quarter.

“Weak peso and elevated oil prices would be at the core of cost-push inflation. Our forward-looking, best guess deprived of a statistical model is an inflation average of 3.5% this year, which implies close to 4% inflation in second half of 2022 as the recovery gains traction,” Mr. Asuncion said.

Security Bank’s Mr. Roces sees inflation to moderate due to base effects in this year.

“However, risks are tilted on the upside with global oil price movements, elevated commodity prices, external supply chain disruptions, and import-dependence on certain food items,” he said.

“Demand-pull may become more pronounced with consumption rebound, but base effects will offset. Moderated levels give BSP some room to maintain accommodative stance in near to medium term to support recovery,” Mr. Roces said.

RCBC’s Mr. Ricafort estimated that year-on-year inflation could mathematically ease to 3% levels due to coming from low base in 2021, but offset by elevated global oil prices among seven-year highs and the prices of other major global commodities among decade-highs recently.

ING’s Mr. Mapa said that domestic inflation will likely be more subdued in 2022, owing in large part to the 2018 rebase of the consumer price index.

“Nonetheless, we could see elevated supply side pressure emanating from still high energy prices and meat inflation persist due to the ongoing unquelled African Swine Fever,” he said. “Demand side pressures are also returning due to improving economic prospects.”

With these developments in mind, below are the BSP’s and analysts’ outlook for each of the key markets:

FIXED-INCOME MARKET

BSP: “The domestic bond market is expected to be liquid with robust demand as the BSP continues to ensure the proper functioning of financial markets. With the market flush with liquidity and with lingering uncertainty, most market players are expected to continue placing funds in safe assets, as evidenced by the high oversubscription consistently seen in the weekly Bureau of the Treasury auctions. Moreover, with the continued accommodative monetary policy stance of the BSP and the appropriate intervention in the secondary market, yields on government securities are expected to remain steady.”

Mr. Asuncion: “The fixed-income market has seen PHP Bloomberg Valuation Service rates continuing to rise with the Ukraine uncertainties even as it was already rising with expectations of a tighter monetary policy stance of the US Fed… and we expect this rising trend to continue for the first quarter this year until tensions simmer down.”

Mr. Ricafort: “The large upward correction in some long-end local bond yields already seen since last year, with an increase of about 170-180 basis points in 2021, so the big moves could have been seen already amid an environment of easing year-on-year inflation at the 3% levels for 2022, thereby could set the valuation for long-term interest rates for 2022 and in the coming years as well.”

Mr. Mapa: “General increase, more pronounced on long rates. Mid-tenor could be impacted by pace of BTr borrowing, projected to be front loaded while rates are low. Short dates to take their queue from potential BSP rate hikes by mid year.”

Mr. Neri: “Local bond yields will likely track the increase in UST (US Treasury) yields with additional upward pressure from government borrowing and possible BSP tightening as a response to the Fed rate hikes.”

EQUITIES MARKET

BSP: “In the near term, stock market volatility is expected to continue in 2022 due to a number of risk factors, including: (1) rising global interest rates; (2) occasional surges in coronavirus infections that may lead to tighter mobility restrictions; (3) local election-related uncertainties; and (4) heightened geopolitical tensions.”

Mr. Asuncion: “The risk asset market has been performing well this 2022, reaching the 7,500 level. It will be highly dependent on local economic news, particularly that of COVID-related ones. Restriction level downgrade would be a welcome development and will definitely bode well for the PSEi’s medium-term prospects. National election uncertainties may, however, mar the improving prospects of the equities market. Second half of 2022 may show more stability as the new administration sets itself up moving forward.

“We expect uncertainties through higher volatility in risk asset markets as investors will be cautious of potential adverse events coming their way, and we have seen the local PSEi respond negatively already to the Ukraine invasion by Russia. Asian currencies, on the other hand, have been quite steady but persistent bouts with flight to safety are undeniable especially as the situation in Ukraine is still very fluid.”

Mr. Ricafort: “The local stock market PSEi could continue to go higher, consistently with improved economic recovery prospects as the economy reopens further towards greater normalcy, leading to higher production, sales, earnings, employment, and overall valuation amid increased vaccination doses towards herd immunity that would effectively reduce the risk of lockdowns.”

Mr. Neri: “We expect a faster economic recovery in the first quarter, especially now that COVID-19 cases are declining. Local stocks have the momentum to go up further especially those in high-contact service industries.”

FOREIGN EXCHANGE MARKET

BSP: “The peso will remain market-driven and will continue to reflect the economy’s long-run macroeconomic fundamentals. The stability of the peso will be supported by structural inflows from exports, overseas Filipino remittances, BPO receipts, and foreign direct investments. These inflows are seen to continue as the domestic economy recovers and external demand strengthens in the next few quarters. The ample international reserves could also buttress the Philippine peso.”

Mr. Asuncion: “Peso has risen to almost the line-in-the-sand of BSP at 51.50 level, but it seems BSP is committed to this level at the moment. However, we also think that the strong USD narrative will continue to persist with the reopening of the global and local economy and the need to tame global inflation and unwind expansionary policies employed due to the COVID-19 pandemic.”

Mr. Ricafort: “The country’s GIR (gross international reserve) could still increase close to the record high of US$110 billion or could even post new record highs for the coming months, in view of the continued growth in the country’s structural US dollar inflows such as OFW remittances, BPO revenues, resumption of foreign tourism receipts (after being disrupted for nearly 2 years by the COVID-19 pandemic), POGO (Philippine Offshore Gaming Operator) revenues, foreign investments [both portfolio and FDIs (foreign direct investments)], though offset by increased imports/wider trade deficit as well as some payment of the country’s foreign debts.”

Mr. Mapa: “General weakening scenario on strong USD theme. Weaker also on both current and financial market outflows.”

Mr. Neri: “Peso is expected to weaken as imports will likely exceed exports and remittances,” referring to financial markets. — Lourdes O. Pilar

![top-view-piggy-bank-money-[freepik]](https://www.bworldonline.com/wp-content/uploads/2022/03/top-view-piggy-bank-money-freepik-640x427.jpg)