Index may retest 7,400 before BSP policy meet

By Sheldeen Joy Talavera, Reporter

THE MAIN INDEX could retest the 7,400 mark this week as the market awaits the Bangko Sentral ng Pilipinas’ (BSP) policy meeting on Wednesday, with a rate cut expected to boost sentiment.

On Friday, the bellwether Philippine Stock Exchange index (PSEi) dropped by 1.36% or 101.15 points to end at 7,310.32, while the broader all shares index shed 0.55% or 22.36 points to close at 4,015.16.

Week on week, the PSEi declined by 2.11% or 157.60 points from its 7,467.92 finish on Oct. 4.

“Last week, negative developments were seen in the local bourse. After five straight weeks of rallying, the market pulled back, giving up its position at the 7,400-7,500 range in the process. Trading has toned down as seen in the thinning value turnover and foreigners have turned net sellers for the past three trading days,” Japhet Louis O. Tantiangco, senior research analyst at Philstocks Financial, Inc., said in a Viber message.

For this week, the market may rebound on bargain hunting before the BSP’s review, he said.

“A rate cut, if delivered, may give the market a boost. Investors are also expected to watch out for clues on the BSP’s policy outlook. If hints of more policy easing would be given, then it is expected to spur optimism amongst investors,” Mr. Tantiangco said.

“We could see a resurgence of selling pressure on Wednesday as investors await the BSP’s policy decision… We believe markets will closely monitor how the recent positive inflation surprise, and rising geopolitical tensions in the Middle East would factor into the BSP’s policy decision and guidance,” Rastine Mackie D. Mercado, research director at China bank Securities Corp., said in an e-mail.

A BusinessWorld poll conducted last week showed that 16 of 19 analysts expect the Monetary Board to cut benchmark interest rates by 25 basis points for a second straight meeting at its policy review on Oct. 16 (Wednesday). This would bring the policy rate to 6% from the current 6.25%.

Jayniel Carl S. Manuel, an equity trader at Seedbox Securities, Inc., said sentiment may be mixed this week “as both technical and fundamental factors weigh in.”

“On the technical front, the PSEi has recently pulled back after peaking near 7,415, now sitting around 7,310, down 1.36%. This decline suggests that the index may enter a consolidation phase or face further downside pressure,” he said.

Mr. Mercado placed the PSEi’s support at 7,100 and resistance at 7,550-7,600.

“The market may retest the 7,400-7,500 range. If it manages to come back to this area, then this will be considered as its support while resistance would be at 7,700. If it fails, however, then this will be its resistance while support would be at 7,150,” Mr. Tantiangco said. “Key downside risks seen for the market are the movement of our currency as well as the tensions in the Middle East.”

Peso may move sideways before BSP policy review

THE PESO may trade sideways against the dollar in the coming days ahead of the Bangko Sentral ng Pilipinas (BSP) policy meeting and following mixed US data released last week.

The local unit closed at P57.205 per dollar on Friday, strengthening by 15.5 centavos from its P57.36 finish on Thursday, Bankers Association of the Philippines data showed.

Week on week, however, the peso sank by 91 centavos from its P56.295 finish on Oct. 4.

“The dollar-peso closed lower amid strong selling pressure on profit taking amid dovish comments from US Federal Reserve officials that they will still cut rates despite the higher-than-forecasted inflation rate,” a trader said by phone.

The peso dropped amid retreating US Treasury yields, the trader added.

The US dollar was flat against major currencies on Friday as markets digested a slew of economic data that supported the Federal Reserve’s current monetary policy path, Reuters reported.

A gauge of US producer prices was unchanged in September, the Labor department reported, the latest economic data to indicate the Fed will likely cut rates again next month.

Consumer prices in September rose 0.3%, according to data released on Thursday, slightly hotter than expected, while weekly jobless claims surged, pointing to labor-market weakness.

The dollar index was flat at 102.91, taking a breather after a recent steady climb that took it above 103 on Thursday, its highest since mid-August on the back of traders reducing bets on further jumbo interest-rate cuts by the Federal Reserve at its remaining meetings this year.

Markets are betting a nearly 91% chance of a 25-basis-point (bp) cut at the Fed’s next meeting and 9% probability of no cut, according to the CME’s Fedwatch tool.

For this week, the trader said the US producer price index data released on Friday is likely to drive foreign exchange trading.

Meanwhile, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message that the peso will move sideways before the BSP’s policy meeting.

A BusinessWorld poll conducted last week showed that 16 out of the 19 analysts surveyed expect the Monetary Board to reduce rates by 25 bps at its policy meeting on Wednesday (Oct. 16). This would bring the policy rate to 6% from the current 6.25%.

The trader expects the peso to move between P57 and P57.40 per dollar this week, while Mr. Ricafort sees it ranging from P56.90 to P57.40.

Reyes Tacandong & Co. Senior Adviser Jonathan L. Ravelas told reporters on Friday that the peso has corrected to the P57 level following some overvaluation due to Fed cut expectations.

He added that the local unit could weaken to as low as P60 per dollar in the coming months if Donald J. Trump wins the US presidential elections.

“When Trump became president in 2016, the peso was at P48, by 2020 when he ended his term, we were at P53. So, if you compute the difference… we could reach P60,” he said. “The tariff war will trigger a peso depreciation.” — A.M.C. Sy with Reuters

Smaller nuclear power plants deemed more suitable for PHL

BUILDING small modular reactors (SMRs) and micro modular reactors (MMRs) could address the variability of renewable energy as opposed to large facilities, an analyst said.

“If the Philippines adds nuclear power to its supply mix, smaller nuclear plants like SMRs and MMRs should be installed rather than large plants,” Pedro H. Maniego, Jr., senior policy advisor of the Institute for Climate and Sustainable Cities, said via Viber.

SMRs are advanced nuclear reactors of up to 300 megawatts (MW) while MMRs have even smaller footprints better suited for regions with no access to reliable power, according to the International Atomic Energy Agency.

”Considering DoE’s target of reducing GHG emissions, power technologies which generate less pollution should be prioritized. However, there must be balanced supply to meet base, mid-merit and peak load requirements,” Mr. Maniego said. “Note that nuclear is base load and not load following.”

With the Philippine Development Plan also aiming at increasing the share of renewable energy, he said that since nuclear plants “cannot ramp up and down and must operate at a relatively constant rate, it could not address the variability of renewable energy supply.”

Mr. Maniego said the Philippines should have “distributed generation” rather than a “centralized” system to suit its archipelagic geography.

Last week, the Department of Energy (DoE) and Korea Hydro & Nuclear Power Co., Ltd., signed a memorandum of understanding on energy cooperation, paving the way for a comprehensive technical and economic feasibility study on the potential rehabilitation of the mothballed Bataan Nuclear Power Plant (BNPP).

The feasibility study, which is targeted to commence in January 2025, will be carried out in two phases. The first phase will assess the current condition of the BNPP and its components while the second phase will evaluate whether the plant can be refurbished optimally.

The BNPP, in Morong, Bataan, was completed in 1985, two years behind schedule, according to the Philippine Nuclear Energy Program.

The removal of the first President Marcos from power as well as the Chernobyl nuclear meltdown left the BNPP idle.

The National Power Corp., as designated caretaker of the power plant, placed it in preservation mode.

The DoE aims to have commercially operational nuclear power plants by 2032 with at least 1,200 MW, gradually increasing to 4,800 MW by 2050.

“Pre-development and development of nuclear power plants take time,” Mr. Maniego said. “2032 looks like a reasonable target year to revive the Bataan Nuclear Power Plant if found to be feasible.”

He said, however, that the country could be tapping nuclear power eight years from now.

“The Philippines needs to quickly augment its power supply to meet its rapidly growing needs. We need sufficient and reliable power supply now, not tomorrow,” he said.

Terry L. Ridon, a public investment analyst and convenor of think tank InfraWatch PH, said expectations need to be managed in regard to the BNPP.

“Even if reviving the BNPP on technical grounds is feasible, there will certainly be concerns on how the revival will be funded, either through government or private funds, or a mixture of both,” he said via Viber.

“More importantly, nuclear proponents should provide a clear value proposition for the revival if other types of generating facilities can provide the same amount of electricity but without the political, social and environmental concerns being raised by nuclear opponents,” he added. — Sheldeen Joy Talavera

This article has been updated to clarify the context in which the source made his remarks.

PHL agri market access project rated ‘satisfactory’ by funder WB

THE World Bank (WB) said it returned a “satisfactory” rating on progress made by the Department of Agriculture in enhancing farmer and fisherfolk market access.

The government borrowed $600 million from the World Bank for the Rural Development Project Scale-Up Project last year. The ultimate goal in improving market access is to boost incomes across selected agri-fishery value chains.

“The overall project’s initial implementation performance is considered Satisfactory,” the bank said in an Oct. 9 implementation status and results report.

The scale-up project aims to support access for micro- to medium-scale agricultural and fishery enterprises to resources, knowledge, and income-generating activities. It also seeks to increase the participation of women in farming and fishery activities.

The bank also issued a “Moderate” overall risk rating for the project.

“Implementation and institutional arrangements are in place and working, including its systems and procedures which build on the experiences and lessons learned from another World Bank-assisted project.”

The bank was referring to the Philippine Rural Development Project, which was expanded by the scale up project.

“This initiative has been instrumental in strengthening the agriculture and fisheries sectors, bolstering rural infrastructure, and enhancing connectivity. The expansion aims to stimulate further growth in these critical sectors and strengthen the nation’s rural economy,” the World Bank said in a June 2023 statement.

To date, 45 infrastructure subprojects (SPs) have been approved with 35 have started procurement. Around 11 enterprise SPs are still undergoing validation.

The rural scale-up project consists of five components: national and local level planning; rural infrastructure and market linkages; enterprise development; project implementation and support; and contingent emergency response.

The World Bank said it has disbursed $35.95 million or 5.9% of the total loan proceeds.

The closing date of the loan is June 30, 2029.

The Philippine Statistics Authority ranks fisherfolk and farmers among the country’s poorest in 2021, with poverty incidence rates of 30.6% and 30%, respectively. — Beatriz Marie D. Cruz

Growth to be sustained with MSME support, upskilling — Philexport

THE Philippine Exporters Confederation, Inc. (Philexport) cited the need to support the expansion of the micro, small and medium enterprises and to resolve the education crisis to sustain growth.

At a general membership meeting last week, Philexport President Sergio R. Ortiz-Luis, Jr. said making MSMEs competitive internationally will help strengthen the middle class.

“(This includes) export promotion, trade facilitation, capacity building, as well as (attracting) foreign direct investment that can help facilitate linkages with and technology transfer from multinational enterprises,” he said.

He cited the need to integrate trade, technology, and tourism into the Department of Trade and Industry’s (DTI) five-point MSME plan.

Meanwhile, he said a robust education and skills development ecosystem is also needed to sustain economic growth, the better to reap the benefits of favorable demographics.

“The inability to absorb more workers into the labor force may negate the benefits of the Philippines’ demographic ‘sweet spot,’” which describes countries with a large cohort of young working-age people.

“This ‘window of opportunity’ has started for the Philippines as its working-age population is now growing faster than the overall population,” he added.

Mr. Ortiz-Luis called for the implementation of the government’s Trabaho Para sa Bayan plan and the Green Jobs Act.

He also cited the need to support manufacturing and agribusiness amid the declining share of these industries in gross domestic product.

“While consumption and the services sector do promote economic growth, it is also critical to arrest the decline of the manufacturing sector’s share of GDP in the country’s poverty reduction efforts,” he said.

“After all, the export and manufacturing sectors can offer stable, regular, and well-paying jobs for unskilled or semi-skilled workers,” he added.

During the meeting, DTI Competitiveness and Innovation Group Director Lilian Salonga noted opportunities in seizing share in the global market for creative services as production and distribution of creative goods continue to go online.

Ms. Salonga said that the Philippine music streaming market has generated $77 million in revenue, representing 31.4% compound annual growth from 2019 to 2023.

Over the same period, exports of creative goods peaked at $1.2 billion.

“Additionally, P-pop’s (Philippine pop) rising popularity has driven about an 800% increase daily in Spotify and also other streaming platforms,” she added.

Citing the Global Innovation Index report released last year, she said that the Philippines ranked 56th among the 132 economies and ranked 10th in creative goods exports within ASEAN.

“This highlights the country’s growth position in global trade. Of course, there is still a vast opportunity if we look into gaining leadership,” she added.

The United Nations Conference on Trade and Development’s (UNCTAD) Creative Economy Outlook 2024 valued global creative service exports at about $1.4 trillion in 2022, up 29% since 2017.

“The UNCTAD report said creative services now represent 19% of all global service exports, up from 12% a decade ago,” she added. — Justine Irish D. Tabile

Bridging the cybersecurity and business strategy gap

IN BRIEF:

• Today’s cyber risks go beyond technical vulnerabilities, where a breach can disrupt supply chains, damage brand reputation, and lead to significant financial losses.

• To mitigate cyber risks and protect business interests, cybersecurity must be integrated into the highest levels of decision-making, aligning security measures with the business’s overall objectives to enhance both security and performance.

• By embedding cybersecurity into the organization’s DNA, C-suite leaders can protect their assets, enhance innovation, and strengthen customer trust.

In the digital era, cybersecurity is no longer just a technical concern — it is a strategic imperative. As organizations embrace new technology to drive growth, the urgency for robust cybersecurity has escalated. However, many businesses still see cybersecurity as a separate function rather than a critical component of their overarching strategy. This disconnect can be costly, as cyber incidents have far-reaching consequences that threaten every facet of the enterprise.

For C-suite executives, integrating cybersecurity into the core business strategy is essential. Cyber threats are increasingly sophisticated, targeting intellectual property, business continuity, and customer trust. To effectively safeguard these assets, companies must bridge the gap between cybersecurity and business objectives, aligning them for maximum protection.

CYBERSECURITY: MORE THAN AN IT ISSUE

Traditionally, cybersecurity was relegated to IT departments as a defensive measure against data breaches, malware, and other threats. However, today’s cyber risks go beyond technical vulnerabilities. A breach can disrupt supply chains, damage brand reputation, and lead to significant financial losses. The average cost of a data breach in 2023 reached $4.45 million, underscoring the financial impact of cyber incidents.

High-profile ransomware attacks on global companies demonstrate that cyber threats are not just IT issues — they are business risks that demand executive attention. For businesses to thrive, cybersecurity must be viewed as a strategic priority that permeates all levels of the organization.

THE COST OF MISALIGNMENT

The misalignment between cybersecurity and business strategy stems from how risk is perceived at the executive level. While financial, market, and operational risks are often discussed in boardrooms, cybersecurity remains the domain of technical experts. As a result, cybersecurity measures frequently lag behind business initiatives like mergers, acquisitions, or digital transformation projects, leaving companies vulnerable.

This reactive approach can lead to crisis management scenarios rather than proactive risk mitigation. For example, adopting cloud solutions without fully assessing security implications exposes sensitive data to potential attacks. When cybersecurity is treated as an afterthought, companies are forced to respond to breaches rather than preventing them, resulting in increased costs and lost opportunities.

To mitigate cyber risks and protect business interests, cybersecurity must be integrated into the highest levels of decision-making. The goal is not just to prevent breaches but to align security measures with the business’s overall objectives, enhancing both security and performance.

EMBEDDING CYBERSECURITY IN DIGITAL TRANSFORMATION

Digital transformation initiatives aim to enhance customer experience, optimize operations, and streamline processes. However, these efforts can introduce new vulnerabilities if security is not embedded from the outset. For example, integrating internet of things (IoT) technologies or migrating data to the cloud can open up new attack vectors.

Cybersecurity should not be seen as a barrier to innovation but as an enabler. By incorporating security considerations into digital transformation, businesses can mitigate risks while maximizing the benefits of new technologies.

CYBERSECURITY AS A VALUE PROPOSITION

In industries such as financial services, healthcare, and e-commerce, where data breaches can have severe consequences, demonstrating robust cybersecurity practices can differentiate a business in the market. Customers are increasingly aware of how their data is handled, and a strong cybersecurity framework can foster trust and loyalty and create a competitive advantage.

By communicating the company’s commitment to data security, executives can build trust and position their brand as a leader in privacy protection.

INTEGRATING CYBERSECURITY INTO RISK MANAGEMENT

Cybersecurity is not just a technical challenge; it is a critical component of enterprise risk management. A cyber incident can affect a company’s finances, operations, and reputation, making it essential to integrate security into the broader risk framework.

C-suite leaders and board members should regularly review cybersecurity performance metrics, monitor emerging threats, and ensure that security investments align with the company’s risk profile. This proactive approach enables companies to anticipate and address cyber risks before they escalate, protecting both the business and its stakeholders.

Effective cybersecurity requires collaboration across all business functions. From HR to finance and operations, each department plays a role in maintaining security. For example, HR can drive a security-first culture through regular training, while finance can ensure that security investments align with business goals.

The C-suite must foster cross-functional collaboration to create a unified approach to cybersecurity. Breaking down silos ensures that security considerations are embedded into every aspect of the business, enhancing resilience and maximizing RoI.

THE ROLE OF LEADERSHIP IN CYBERSECURITY INTEGRATION

Successful integration of cybersecurity into business strategy requires strong leadership from the top. Executives must champion cybersecurity as a core business priority, actively participating in shaping security strategies and ensuring alignment with business objectives.

This begins with a shift in mindset: understanding that cybersecurity is not just about preventing breaches but enabling secure, long-term business growth. Regular communication between cybersecurity teams and the board ensures that the organization remains agile and prepared for emerging threats.

In an era of escalating cyber risks, companies that fail to align cybersecurity with their business strategy do so at their own peril. By embedding cybersecurity into the organization’s DNA, C-suite leaders can protect their assets, enhance innovation, and strengthen customer trust. Those that bridge the gap between cybersecurity and business strategy will be better positioned to navigate the complexities of the digital age, turning security from a defensive measure into a strategic advantage.

To thrive in the digital age, executives must integrate cybersecurity into their business strategies, emphasizing the importance of aligning security with organizational goals for a holistic, proactive approach.

This article is for general information only and is not a substitute for professional advice where the facts and circumstances warrant. The views and opinions expressed above are those of the author and do not necessarily represent the views of SGV & Co.

Carlo Kristle G. Dimarucut is a technology consulting partner of SGV & Co.

PHL, Brunei tackle closer ties in agri, food, and RE

PHILIPPINE SENATE President Francis “Chiz” G. Escudero and Brunei Ambassador to the Philippines Megawati Manan have discussed exploring closer cooperation in agriculture, food security, and renewable energy (RE) between both countries, a Senate office said at the weekend.

In a statement, the Senate Public Relations and Information Bureau said Mr. Escudero updated Brunei’s envoy on Manila’s efforts to implement solar-powered irrigation to boost crop production.

“They also agreed on the importance of diversifying trade partners for food security where Ambassador Manan emphasized their growing interest in importing raw products from the Philippines,” the statement read.

Brunei has been sharing their expertise in the production of halal products with the Philippines. In August, Ms. Manan said at a forum that Brunei could also help the Philippines bring halal products to the Middle East.

In May, Philippine President Ferdinand R. Marcos, Jr. said both countries would focus on developing two economic corridors, one of which will cover parts of Mindanao and Palawan, to boost linkages between regional supply chains.

Moreover, the Senate president and diplomat also discussed the importance of allowing long-term land leases for foreigners.

Senators are tackling at the committee level Senate Bill No. 2717, which will amend the Investors’ Lease Act through the extension of lease of private land, excluding agricultural land, to 99 years from the current 75. The bill is among the priority measures of the Marcos administration.

Under the measure, filed by Mr. Escudero in July, investors may also sublease a leasehold interest on a property, subject to the provisions of the original contract.

The Senate president told the envoy that the chamber eyes passing the bill before the year ends.

“Attracting foreign investors has been a long-standing priority of the government, spanning several administrations.” the Philippine Senate president said in the bill’s explanatory note.

They also briefly discussed the implications of the law on delineating maritime zones, as well as the recently-signed Self-Reliant Defense Posture Revitalization Act, which seeks to build up the country’s defense industry.

The Philippine Congress have approved two complementary bills, the Maritime Zones Act and The Philippine Archipelagic Sea Lanes Act, awaiting signature. The President also recently enacted a measure that will boost local production of defense equipment. – John Victor D. Ordoñez

Ombudsman clears ex-DoH chief

THE OMBUDSMAN has cleared former Health Secretary Francisco T. Duque III of grave misconduct charges related to the illegal fund transfer of over P41 billion from the Health department to the Procurement Service of the Department of Budget and Management (PS-DBM) between March and December 2020 to purchase coronavirus disease 2019 (COVID-19) medical supplies and equipment.

Ombudsman Samuel R. Martires cleared the Duterte administration’s Department of Health (DoH) secretary of grave misconduct and gross neglect of duty as Mr. Duque had already severed ties with the government when former President Rodrigo R. Duterte left office on June 30, 2022.

“Following the Supreme Court’s pronouncements in Andutan as further clarified in Jamorabo, this Office is constrained to hold that Duque is ‘no longer the proper subject of an administrative complaint’ in connection with the irregular fund transfers to PS-DBM during his stint as DoH Secretary,” it said in a 10-page order. It also said it found no evidence that Mr. Duque’s separation was attended by bad faith.

The Ombudsman earlier this year ruled Mr. Duque administratively liable for Grave Misconduct and Conduct Prejudicial to the Best Interest of the Service concerning the series of fund transfers by the DoH from March to December 2020 to PS-DBM totaling over P41.46 billion.

The funds were transferred to outsource DoH’s procurement of COVID-19 medical supplies and equipment to PS-DBM sans compliance with the requirements by law.

The Ombudsman earlier said the arrangement where PS-DBM was brought in as DoH’s procurement agent resulted in a more complicated process, inconsistent with the purpose of hastening project implementation. — Chloe Mari A. Hufana

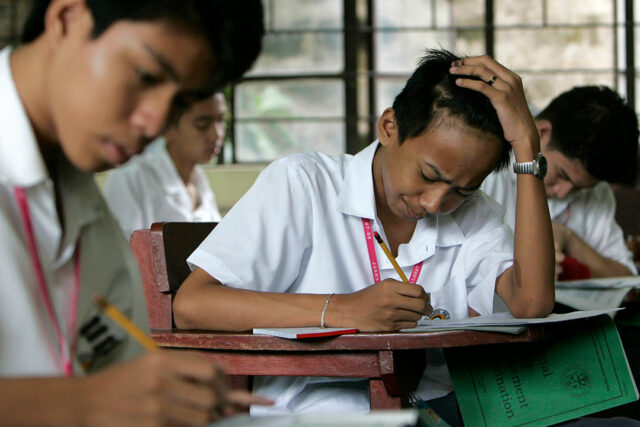

Mother tongue law slammed

A CONGRESSMAN on Sunday slammed the lapsing into law of a measure discontinuing the use of mother tongue in the classroom for early learners, saying the move is a “step backward” in honing students’ sense of nationalism and critical thinking skills.

“Removing the Mother Tongue as a medium of instruction is a step backward from providing better quality education to the youth,” Deputy Minority Leader and Party-list Rep. France L. Castro said in a statement in mixed English and Filipino. “Abandoning the Mother Tongue is turning away from our country’s various languages and their contributions to the diverse cultures we have.”

President Ferdinand R. Marcos, Jr. inaction on the measure allowed it to lapse into law, going in the books as Republic Act No. 12027, ceasing the use of mother tongue as a medium of instruction for kindergarten to grade 3 students.

The new law mandated the use of Filipino and English as mode of classroom instruction, relegating regional languages as “auxiliary media” for class discussions. — Kenneth Christiane L. Basilio

Minimal NAIA disruption assured

SAN MIGUEL-LED New NAIA Infra Corp. (NNIC) is in talks with airline companies to ensure smooth transition and minimal disruption on operations for the closure of Terminal 4 for renovation.

“Our goal is to make Terminal 4 more comfortable and efficient for travelers. While there may be some temporary disruptions, we appreciate the public’s understanding and patience as we work to deliver these much-needed improvements,” NNIC said in a media release over the weekend.

NNIC said the Terminal 4 of Ninoy Aquino International Airport (NAIA) is scheduled for renovation and upgrade beginning Nov. 6 to improve the terminal’s overall infrastructure and passenger flow.

The upgraded new terminal will reopen in February 2025.

NNIC has yet to disclose the investment cost of Terminal 4 renovation, but the group said previously that it is allocating P123.5 billion for overall capital expenditure of the NAIA project.

NNIC formerly SMC SAP & Co. Consortium is composed of San Miguel Corp.; RMM Asian Logistics, Inc.; RLW Aviation Development, Inc.; and Incheon International Airport Corp.

For now, all airlines operating at Terminal 4 will relocate to Terminal 2, the new NAIA operator said, adding that on average Terminal 4 manages about 2,900 passengers per day or about 2.23% of NAIA’s total daily passenger volume.

Budget carrier Cebu Pacific, operated by listed Cebu Air, Inc. said it is relocating the operations of its regional brand Cebgo to Terminal 2 from Terminal 4 effective Nov. 7.

Cebu Pacific said flights to Busuanga (Coron), Caticlan (Boracay), Cebu, Legazpi, Masbate, Naga, San Jose, Siargao, and Surigao will be transferred to Terminal 2.

Boutique airline AirSWIFT Transport, Inc., which was recently acquired by Cebu Pacific is also transferring its operations from Terminal 4 to Terminal 2 starting Nov. 5.

NAIA’s private operator, NNIC took over the operations and maintenance of NAIA on Sept. 14.

According to NNIC, its terminal reassignment plan is to designate Terminal 1 for Philippine Airlines, Terminal 2 for domestic flights, Terminal 3 for all foreign airlines including Cebu Pacific and AirAsia Philippines’ international flights, and Terminal 4 for AirAsia Philippines’ domestic operations. — Ashley Erika O. Jose

DILG, Trade chiefs await CA action

THE Commission on Appointments (CA) has received the appointment papers of recently installed Cabinet members of the Marcos administration, a congressman said on Sunday, noting the body can’t formally deliberate their nominations as Congress is still on break.

The constitutional committee already has on file Interior Secretary Juanito Victor “Jonvic” C. Remulla, Jr. and Trade Secretary Ma. Cristina Aldeguer-Roque papers, Surigao del Sur Rep. Johnny T. Pimentel, an assistant minority leader of the body, said.

“We won’t be able to tackle [their] appointment for now because Congress is adjourned. We are not in session,” he said in a statement.

He said the newly appointed Cabinet officials could still perform their duties while awaiting confirmation from the CA, citing President Ferdinand R. Marcos, Jr.’s ability to make interim appointments, empowering nominated officials to immediately perform their responsibilities.

Mr. Remulla, younger brother of Justice Secretary Jesus Crispin C. Remulla, last week replaced former Department of Interior and Local Government (DILG) Secretary Benjamin “Benhur” C. Abalos, Jr., who is eyeing a Senate seat in the 2025 midterm elections.

Ms. Roque sat as acting secretary of the Department of Trade and Industry (DTI) on Aug. 2, taking the reins after ex-Trade Secretary Alfredo E. Pascual’s resignation from the post on Aug. 1. — Kenneth Christiane L. Basilio