Yields on gov’t debt rise on faster June inflation

YIELDS on government securities (GS)rose last week after inflation surged to its fastest level in nearly four years in June.

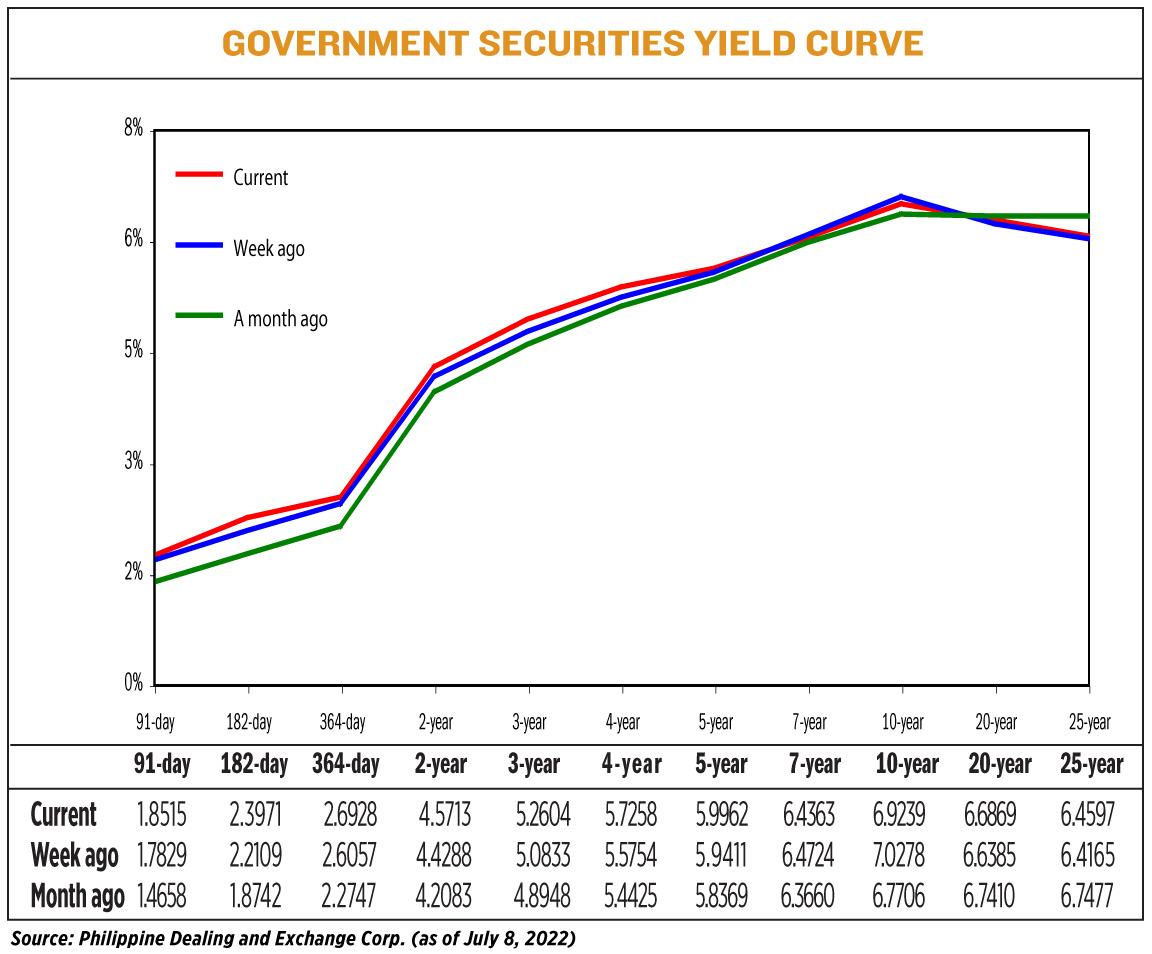

GS yields, which move opposite to prices, rose by an average of 7.44 basis points (bps) week on week, based on the PHP Bloomberg Valuation (BVAL) Service Reference Rates as of July 8 published on the Philippine Dealing System’s website.

Yields climbed nearly across the board last week, except for the seven- and 10-year bonds, which lost 3.61 bps and 10.39 bps, respectively, to fetch 6.4363% and 6.9239%.

The rates on the 91-, 182-, and 364-day Treasury bills rose by 6.86 bps, 18.62 bps, and 8.71 bps to 1.8515%, 2.3971%, and 2.6928%, respectively.

The belly of the curve also went up as yields on the two-, three-, four-, and five-year Treasury bonds (T-bonds) increased by 14.25 bps (4.5713%), 17.71 bps (5.2604%), 15.04 bps (5.7258%), and 5.51 bps (5.9962%).

Likewise, the rates of the 20- and 25-year papers rose by 4.84 bps (6.6869%) and 4.32 bps (6.4597%), respectively.

GS volume reached P8.31 billion on Friday, higher than the P7.51 billion seen in the week ending July 1.

“Peso bond yields climbed week on week after the release of the June inflation data, which clocked in higher than expected,” a bond trader said in a Viber message.

ATRAM Trust Corp. Head of Fixed Income Jose Miguel B. Liboro likewise attributed the higher rates to the release of June inflation data.

“Key drivers [last] week were inflation and the four-year [bond] auction. The move higher in June inflation was significant but in-line with market expectations,” Mr. Liboro said in an e-mail.

Headline inflation quickened to a near four-year high of 6.1% year on year in June amid soaring food and transport prices. This was up from 5.4% in May and 3.7% in June last year. It was also the fastest pace since October 2018.

The June headline print brought inflation in the first half to an average of 4.4%, above the central bank’s 2–4% target but still lower than its 5% forecast for this year.

Meanwhile, on Tuesday, the Bureau of the Treasury raised P35 billion as planned from its offer of reissued seven-year T-bonds. The bonds, which have a remaining life of three years and seven months, attracted P56.236 billion in bids.

Accepted yields for the paper ranged between 5.6% and 5.999%, with the average rate settling at 5.908%. This was 117.6 bps higher than the 4.732% average yield fetched for the tenor when it was last auctioned on Jan. 21, 2020.

“The currently elevated USD/PHP exchange rate isn’t also helping sentiment for peso bonds as it could also add to local inflationary pressures,” the bond trader said.

“It also looks like the US Federal Reserve will continue to be aggressive on its rate hike plans following the release of FOMC (Federal Open Market Committee) minutes that Fed officials are open to a more restrictive monetary policy stance to tame inflation,” the bond trader added.

Bangko Sentral ng Pilipinas (BSP) Governor Felipe M. Medalla last week said the central bank is prepared to raise its policy rate by 50 bps at its Monetary Board meeting on Aug. 18 as the peso hit the P56 level against the dollar on Thursday.

The peso hit another near 17-year low on Thursday after closing at P56.03 against the dollar. It was the weakest performance of the local unit against the greenback since the P56.30 against the dollar on Sept. 27, 2005. It was also 39 centavos shy of the record low of P56.45 to a dollar on Oct. 14, 2004.

This week, the bond trader sees GS yields continuing to trade higher amid a lack of catalysts.

“If the 75-bp US Fed hike actually happens, the BSP’s policy rate will be on a par with that of the US Fed’s at the 2.5% level, barring any off-cycle rate hike by the BSP as its next policy rate meeting is scheduled on Aug. 18,” the trader said.

Mr. Liboro also expects rates to trend gradually higher, with the seven-year bond auction on Tuesday seen as the main driver of trading activity this week.

“Current indications project market demand in the 6.80-7% area. Given expectations that inflation has yet to hit its peak for the year and more hawkish rhetoric from the BSP recently, we expect upward pressure on rates to persist over the month. However, at the 7% area we see longer-term value on the tenor and expect decent demand at the level,” Mr. Liboro added. — Mariedel Irish U. Catilogo